As the COVID-19 pandemic continues, SMART mourns the deaths of those members who put their lives on the line during this global crisis.

It is important for us to work together during this crisis to prevent further deaths while thanking those doing the work to maintain our nations’ critical infrastructure and keep us safe.

We send our deepest sympathies and condolences to their families, extended families, friends, their Locals, and all who knew them.

Joseph Hansen, SMART-TD Local 60, Newark, N.J. April 7, 2020

Joseph Hansen, a 20-year SMART Transportation Division member out of Local 60 (Newark, N.J.), passed away from COVID-19. Hansen was 62 years old and had been a SMART-TD member since November 1999. He worked out of NJT’s Raritan Yard. “Brother Hansen’s 20 years of service was exemplary. He was the consummate professional, a loving husband, father and grandfather,” said General Chairperson Jerome Johnson (GCA-610), who is president of Local 60. “He will be greatly missed.” (Read more)

• • •

Jory J. Bohanan, SMART-TD Local 1607, age 39, North Hollywood, Calif., died March 29, 2020.

A member of the union since 2007, he had previously worked for L.A. Metro and had only worked a couple of months for MV Transportation, which contracts with Santa Clarita Transit. “My son, he was a great man. He had a big heart. He was a genuine, good person, and he was easy-going,” his father, Darryl Bohanan, told the Santa Clarita Signal. Jory is survived by his children and was engaged to be married. A GoFundMe had been set up to assist his family.

• • •

Kenneth R. Jackson, SMART-TD Local 1337, age 73, Brusly, La., died April 1, 2020. Brother Jackson was a veteran of the Vietnam War and a retired Union Pacific conductor.

• • •

Donnie Carson, SMART-TD Local 1908, age 69, Buffalo, N.Y., died April 3, 2020.

• • •

Domingo Tovar, SMART-TD Retired Local 23, Santa Cruz, Calif., April 14, 2020

Brother Tovar, 68, served two stints with Santa Cruz Metro as a bus operator starting in 1982, then leaving for another carrier before returning to Santa Cruz in 1987. He was involved in the initial contract talks with the carrier as well as a 37-day strike against in 2005.

He served a year as secretary and treasurer for Local 23.

“He had many friends. He was a happy person,” said retired Local 23 member Serena Tovar, Brother Tovar’s wife of more than 43 years and a 30-year SMART-TD member. “Domingo remained the same type of person the day she met him to the day he passed. He was always happy. He just loved life and had no regrets. He was very proud of his kids and was always there for his family.”

• • •

Michael A. Hill SMART-TD Local 61, Philadelphia, Pa, April 14, 2020

Brother Hill was a 30-year member of SMART-TD and worked for the Southeastern Pennsylvania Transit Authority (SEPTA). He was the second active member fatality for SMART-TD reported from the virus following New Jersey Transit conductor Joseph Hansen.

• • •

Rameliah “Reme” Jennings, SMART-TD Local 1589, age 74, Scotch Plains, N.J., died April 22, 2020.

Brother Jennings spent much of his career with United Parcel Service (UPS). After he retired, in 2007 he tapped into his love for driving and worked part-time with Suburban Bus Company (Coach USA). In typical “Reme” fashion, he bonded with the staff at the company and was well admired and loved. He joined the union in 2011. Brother Jennings, an ordained minister, was a globetrotter and was constantly on the go! He had the opportunity to travel to Europe, Asia, Africa, and the Caribbean. He was also an avid sports fan and was passionate about his golf game. He served as associate pastor at First Park Baptist Church in Plainfield, N.J. The Rev. Jennings leaves to cherish fond memories, his wife of 35 years, Dorothy, his children, sisters and many nieces, nephews, and friends.

• • •

Kenneth K. Skoog, retired from SMART-TD Local 1177, age 90, Whapeton, N.D., died April 24, 2020. An Air Force veteran, Brother Skoog began working for the Great Northern Railroad in 1951, which later merged with the Burlington Northern Railroad. He retired in 1993 after 43 years of service.

• • •

Stephen G. McFadden, SMART-TD Local 61, age 51, Philadelphia, Pa., died April 30, 2020. Brother McFadden was a SEPTA conductor and a member of the union since September 1991. “I saw him at every union meeting we had – and sometimes he was the only person there,” said Bernard Norwood, general chairperson of GO-STA. “Stephen was very committed to the union. He was a really nice guy.” Using money out of his own pocket, Brother McFadden donated to the local’s annual holiday party without fail, Norwood said. He was a very passionate Phillies fan – sometimes catching part of the game during the down time he had during a shift and filling in his union brothers and sisters on what was going on – and making sure the game was on the TV in the crew room.

• • •

Rony L. Jacobs, SMART-TD Local 30, age 69, Alma, Ga., died May 9, 2020. A retiree from Amtrak, Brother Jacobs was a conductor for the carrier for 40 years.

• • •

George Appiah-Kumi, SMART-TD Local 1589, age 63, Somerset, N.J., a union brother, friend and co-worker passed away May 18, 2020, at RWJ Hospital in New Brunswick. as a result of COVID-19.

George has been part of Suburban Transit since July 7, 2014.

“His dedication to his work and strong union activism are the reasons why he was well appreciated and liked by both management and union,” said General Chairperson Gordon Harris, who is also Local 1589’s president. “I will always remember his soft, quiet voice and brilliant smile every time we ran into each other at work. George was a team player and has helped out many times even on short notice. May his soul rest in peace.”

• • •

Wilfredo Corsino, SMART-TD Local 1607, age 65, Los Angeles, Calif., died June 11, 2020. A bus operator for L.A. Metro out of Divisions 7, 10, and 13, he joined the union in 1996. “Many operators remember Brother Corsino’s infectious laugh and his love for Metro. Many of his co-workers stated that he was a great ping-pong and pool player,” GC John Ellis said.

• • •

Retiree Luther “Junior” Lawson, SMART-TD Local 1315, Florence, Ky., age 89, passed away Aug. 26, 2020, as a result of COVID-19. He joined the union in 1970 and was a brakeman for CSX.

• • •

Ramon Gamez, a SMART-TD Local 1563 member, passed away from COVID-19 on Aug. 21, 2020, at age 55. A Los Angeles County Metropolitan Transportation Authority worker, Brother Gamez worked out of Division 3202 and was hired December 21, 1997.

Well-liked by his co-workers, Brother Gamez was a great family man and is survived by his wife, Sonia Gamez; daughter, Alejandra Gamez; and son Ramon Gamez Jr., a SMART-TD member out of Local 1565. Brother Gamez loved to play chess, take trips to the lake, go to Las Vegas and go to the movies with his family.

“He was very friendly and outgoing and will truly be missed,” General Chairperson John Ellis said.

• • •

Member Bobby D. Jones Jr. of Local 11 (Houston, Texas) passed away on July 9, 2020, from COVID.

He was an engineer for Union Pacific and a member of the union for more than 14 years.

• • •

Rohan Johnson, SMART-TD Local 1715, Gastonia, N.C., age 59, a member of the union since February 2012 who worked for the Charlotte Area Transit System (CATS), passed away on Aug. 30 from COVID-19.

“He was known as dependable man that would help anyone in need,” Bus Department Vice President Alvy Hughes said.

“A respectful, loving and caring husband, father, and friend,” his wife posted. “Was loved and will be sadly missed by many.”

• • •

Christopher Bruce Skaggs, 49, of Mammoth Spring, Ark., died on Monday, October 26, 2020 at Fulton County Hospital in Salem, Ark. Brother Skaggs was a former president of Local 607 (Thayer, Mo.) and a former legislative secretary of the Missouri State Legislative Board.

• • •

Jose “Joe” Alfaro, a member of SMART Transportation Division for more than 15 years, died from COVID-19 on Nov. 13. He was 58 years old. Brother Alfaro was a member of Local 18 in El Paso, Texas, and worked as a trainman/brakeman for Union Pacific.

He leaves behind his wife of 22 years, Ruoana and four children: Avan Brian, Mia Brianna, Vanessa and Robert.

• • •

Miguel “Mike” Gaitan, 64, an active SMART Transportation Division member out of Local 1241 (Richmond, Calif.), passed away Friday, December 11, 2020, from COVID-19. An engineer with BNSF, he joined our union in February 1995.

“Mike was larger than life, his kindness, his funny laugh and his ability to be a leader in the railroad family was not rivaled,” California State Legislative Director Louis Costa said. “He will be deeply missed.”

Brother Gaitan is survived by his wife, Alice, and four children, Megan, Mike Jr., Santiago and Dolores. He also had two grandchildren.

• • •

Guss Z. Mitchell, a member of Local 1313 (Amarillo, Texas), died from COVID-19 on Dec. 26, 2020. He was 42.

Brother Mitchell joined our union in September 2001 and was the father to a son and a daughter.

“Guss loved hunting, fishing, the mountains, family and friends. Most of all he loved his children,” his obituary stated.

• • •

Laureen Young Jr., 59, a 34-year member out of Local 1565 who worked as a train operator for the LACMTA, passed away Dec. 27, 2020, from complications associated with COVID-19.

• • •

Angel Lomeli, a 14-year member of our union, passed away Jan. 5, 2021, from COVID-19. He was 48 years old.

Brother Lomeli was a member of Local 1846 (West Colton, Calif.) and worked as a trainman for Union Pacific.

“God gained the absolute best angel today, we miss you but a soul as beautiful as yours will never be forgotten,” his family wrote on a memorial fundraiser page in his memory.

He is survived by his wife, five children and four grandchildren.

• • •

Kelly Orrick of Local 221 (North Little Rock, Ark.) passed away Dec. 28, 2020, at age 60 from COVID-19.

He had been a member of our union for 22 years and worked as a trainman/brakeman for Union Pacific.

He is survived by his wife, son and two grandsons.

• • •

Steven Shaner, a former vice president of Local 316 (Clinton, Iowa) and vice local chairperson of LCA-225C, passed away Dec. 31, 2020, from COVID-19.

He was a member of our union for more than 21 years and worked as an engineer for Union Pacific. He served as vice president of his local from 16 months starting in Jan. 2012 and as vice local chairperson for more than six years.

He is survived by his wife of 34 years, Karen, two sons and two daughters.

• • •

Bryant D. Armstrong, 46, of Local 835 (Bakersfield, Calif.), a trainman/brakeman for Union Pacific and a member of our union for four years, passed away Feb. 17, 2021, from COVID-19.

• • •

Johnny Ira Cohen, 58, a member of Local 998 (Waycross, Ga.), died Feb. 21, 2021, from COVID-19. He was 58.

A member of our union for more than 16 years, he worked as a conductor for CSX.

He is survived by his wife, Gayle; three daughters; a son; and six grandchildren.

• • •

Local 1067 member Alvin Wigfall, 64, of Superior, Wis., died Friday, April 9, 2021, at St. Luke’s Hospital in Duluth, Minn., from COVID-19.

Wigfall hired out with Canadian National as a conductor in June 1998 where he would spend the next 21 years of his career. He went out on disability/E-49 status in November 2019 and was unofficially retired.

“He was a really kind person. I mean that’s the biggest thing about Al, he was just so kind-hearted. He was a kind, gentle, good-hearted person. He was loved by everyone he worked with,” Local 1067 President Kevin Holden said.

• • •

Local 225 President Jason Ruffing, 40, of Attica, Ohio, died April 21, 2021, at Mercy Health St. Charles Hospital in Oregon, Ohio, from COVID-19.

• • •

Brother Thurman Wheeler, 47, of Local 1348, died April 30. 2021, of COVID-19. He was a conductor for Union Pacific and a member of our union for six years.

• • •

Jaime Garcia-Perez, 48, a member of our union for more than 15 years out of Local 23 (Santa Cruz, Calif.), passed away Sept. 3, 2021, from complications of COVID-19. He was an operator for the Santa Cruz Metro ParaCruz.

“Jaime, who worked at ParaCruz for nearly 17 years, had an unwavering work ethic and the utmost respect from everyone here at Metro. He was an integral part of ParaCruz from Day One,” GCA Vice General Chairperson Nathanael Abrego and General Chairperson James Sandoval said in a letter to membership. “A hard-working man and full of passion, integrity, and respect. When the workday got hard, we leaned heavily on the ‘Jaime Factor’ because he counted as two drivers. He was that good. You can always count on him to ensure our riders got to their destination on time.

“Jaime was loved by all who knew him. He will be missed.”

Brother Garcia-Perez is survived by his wife of 25 years, Dawn; daughter, Madison; and son, Kaden.

• • •

Joseph Zepeda, 55, a member of Local 524 (Palestine, Texas), died on Sept. 3, 2021, from COVID-19.

A member of our union for 23 years, he worked as a conductor for BNSF.

“He was loved by so many and will be missed, but never forgotten,” his obituary stated.

He is survived by his wife of 31 years, Tracy and five children.

• • •

Local 1563 member Marco Gomez, a bus operator for Los Angeles County MTA, passed away Sept. 7, 2021, from complications of COVID-19.

Brother Gomez, 37, was a member of our union for more than seven years.

• • •

Sister Terri Poole Taylor Kerns, 52, of Local 1971 (Atlanta, Ga.) lost her life to COVID-19 on Friday, September 10. Diagnosed with COVID-19 on August 24, she was hospitalized Sunday, August 29 with severe chest pains. After suffering from cardiac arrest, she passed in the early hours of Sept. 10.

She hired out with Norfolk Southern, where she would work for 20 years, earning her engineer and conductor certifications and working her way up to the position of yardmaster.

• • •

Brother Manuel Tellez III, a member of our union for 23 years, passed away Sept. 10, 2021, from COVID-19. He was 54 years old.

Brother Tellez served in the Marine Corps and was honorably discharged before beginning his journey with Union Pacific, where he loved his job as a train conductor extraordinaire.

“Manuel loved telling stories like the time he derailed the train that was full of Lexus SUVs. It was never a dull moment with him!” wrote Karl Wilson, local chairperson of LCA-887A. “Manuel leaves a Legacy with us all and we will remember the great times spent with him and the great stories he always shared.”

Brother Tellez loved spending time with his family such as camping and road trips across the states. Other favorite activities included cooking BBQ, sports, a good cigar and helping others as he made his mark in society. He will be greatly missed by his wife and family.

• • •

Brother Ryan D. Moe, 37, a member of Local 13 (Huron, S.D.) and conductor for both Rapid City, Pierre & Eastern Railroad and BNSF, out of Gilette, Wyo., died Sept. 11, 2021, from COVID-19.

“I always got along with him and he was always behind the organization and any decision I felt was best for us,” said Mike Decker, vice general chairperson of GCA-13 “He was a good one for sure.”

• • •

Brother Thomas A. Pilger, a member of Local 1949, passed away Sept. 13, 2021, from COVID. He had worked for Conrail, Norfolk Southern and was beginning a new position with CSX before his passing.

“He will be deeply missed by all that knew him,” his obituary states.

He is survived by his wife of 21 years and five daughters.

• • •

Brother Darrell Lynn Graves, 59, of Local 894, a member of our union for nearly eight years and a conductor for BNSF, passed away Sept. 22.

His family said he had great artistic ability and loved hunting, fishing, shooting, and International Harvester Scout vehicles.

He is survived by his wife, Sandy, three children and four grandchildren.

• • •

Brother David Harris, 60, a member of Local 1626 (Anchorage, Alaska), died Sept. 25, 2021. Brother Harris was a member of our union for 29 years and worked as an engineer for the Alaska Railroad.

He is survived by his ex-wife, two stepsons and three step-grandchildren. After his death, the Alaska Railroad held a vaccination clinic in his memory, which was featured in an article from the Anchorage Daily News.

• • •

Sister Denise Sargent, 56, a member of Local 1785 and Santa Monica motor coach operator, passed away Oct. 1, 2021.

A member of our union for more than 22 years, joining the organization in August 1999, she was a Santa Monica native, attending local schools there, had a passion for motorcycles and was a member of the Buffalo Soldiers Motorcycle Club.

A colleague of hers on the Big Blue Bus said Sister Sargent was a “loving, kind and polite person who was always friendly with co-workers and the general public.”

Santa Monica City Council adjourned its meeting Oct. 12, 2021, in honor of Sister Sargent after reading a eulogy for her.

Sister Sargent is survived by her daughter, Shamika Holt; two grandchildren; four sisters and three brothers.

• • •

Brother Patrick Jay Harrison, 49, of Powder Springs, Ga., a member of Local 1971 (Atlanta, Ga.), passed away Oct. 4 from COVID.

A member of our union for nearly 21 years, he was a yardmaster for Norfolk Southern.

Brother Harrison is survived by his wife of 27 years, Amanda; two sons; and numerous other relatives.

• • •

Brother Larry Kirkwood, 47, of Local 1557 (Memphis, Tenn.) and a member of our union for a decade, passed away on Oct. 14, 2021, from COVID-19.

He worked as a conductor for Canadian National.

• • •

Brother Tony Carbajal, a member of Local 807 (Tucson, Ariz.), passed away Oct. 27, 2021, from COVID-19 at the age of 51.

He joined the union in 2004 and worked as a conductor for Union Pacific for more than 17 years.

“Tony was well-liked and respected by his co-workers in Tucson,” said Chris Cheely, legislative secretary of the Arizona State Legislative Board and Local 807’s legislative representative.

A talented golfer and softball player, one of Brother Carbajal’s many hobbies was collecting cigars.

He is survived by the love of his life, Patricia; sons Eric, Gregory and Andrew and grandchildren Stephany and Bubba.

• • •

JeMare Williams, a member of Local 278 (Jackson, Mich.), died Nov. 2, 2021, of COVID-19. He was 50 years old.

Brother Williams joined our union in May 2018 and worked as a conductor for Norfolk Southern.

Local 278 Secretary and Treasurer Jennifer Paull described Brother Williams as “a great man and coworker.”

• • •

Brother Jeffery M. Weaver of Local 340, age 55, passed away from COVID-19 on Dec. 26, 2021.

He joined our union in March 2009 and worked as an engineer for CSX. He is survived by his wife, Carla, and his two daughters, Krista and Kayla.

• • •

Member Bradley Hutchings, 46, out of Local 313 (Grand Rapids, Mich.), passed away from COVID on Jan. 10, 2022.

He was a member of our union for five years and worked as a conductor for Grand Elk Railroad.

• • •

Thomas R. Christensen SMART SM Local 9, Denver, CO. A member since 1965.

• • •

Warren H. Hodges, SM SM Local 66, Everett, WA.

• • •

Reyernesto Mendoza, SM Local 105, Los Angeles, CA. Brother Mendoza was a 25 year sheet metal member who started his career in 1995 and worked at Critchfield Mechanical. In a message on the Local 105 website, SMART Local 105 Vice President Steve Hinson described Rey as someone who always had a smile on his face and a positive attitude. On Facebook, many of his fellow union members expressed their condolences and described Rey as a hard worker. According to an article from KTLA News, “Rey was one of those guys you meet along your path that you would never forget. A great man who will be missed dearly,” one member wrote. His Local 105 brothers and sisters set up a GoFundMe website for his family.

• • •

Thomas L. Leonard, SM Local 20, Hobart, IN. Brother Leonard passed away Thursday, April 23, 2020. He was born in Gary, Indiana on November 24, 1942 and graduated from Hobart High School in 1961. A long time member in Indiana, he retired from Area Sheet Metal in 2000. He was survived by his son and two daughters.

• • •

Anthony L. Rush, SM Local 20, Indianapolis, IN. Brother Rush passed away on the evening of March 28, 2020. He was born in Indianapolis on January 10, 1953 and was a member of St John Missionary Baptist Church in his hometown. He retired in 1997 after over 18 years at Bright Sheet Metal and as a long time member of SM Local 20.

• • •

Stanley E. Turner, SM Local 20, Evansville, IN. Stanley E. Turner II passed away on Monday April 6th, 2020. He was born in Cape Girardeau, Missouri on Sept 26, 1945. His family settled in Evansville early in his childhood and he attended North High School, graduating in 1963. He joined the Navy and served 2 yrs active duty and 23 yrs of reserve duty with his highest ranking at retirement as a Chief Petty Officer. During his time at sea, he learned his craft as a Sheet metal journeyman and welder. He was an active member of Local 20 and served as a union steward during his career. He was known for his work ethic, integrity and high level craftsmanship. He was a long time member of his church and after retirement, he would volunteer his time using his craftsmanship to perform maintenance and special projects for his fellow church members.

• • •

Gerald Carson, Local 63, Springfield, MA

• • •

Bob Olwig, Local 36

Felix M. Bottalico, SMART SM Local 100

Felix M. Bottalico passed away suddenly on January 8, 2021. Felix was a longtime sheet metal instructor. He joined Local 100 in 1979, graduated from Local 100’s training center and later became an instructor. Felix taught classes on sheet metal, was a proficient welder & enjoyed crafting artisanal pieces and collecting tools.

His sheet metal skills were exceptional. During his tenure at the Architect of the Capitol he received a craftsmanship award for his work on the roof of the Philip A. Hart Senate Building. Felix taught a generation of Local 100 brothers and sisters to do their job to the best of their ability.

A former colleague expressed it well when she said, “Felix’s drive to see everyone around him do well was genuine.” What more can be asked of a teacher and a friend?

Felix is survived by his children, brothers, and many family members. He will be greatly missed by his brothers and sisters at Local 100 as a teacher, friend, co-worker, and skilled craftsman.

With the latest information from the CDC now suggesting that the general public use homemade masks or scarfs when going out in public, we wanted to provide you with information on using them to protect you and your families during the current pandemic.

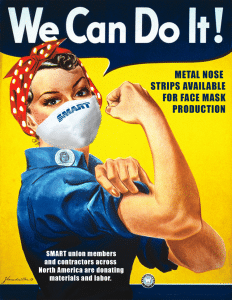

With the latest information from the CDC now suggesting that the general public use homemade masks or scarfs when going out in public, we wanted to provide you with information on using them to protect you and your families during the current pandemic. SMART sheet metal members stand ready to produce free metal nose pieces for the millions of masks being made by volunteers across the US and Canada. If you are a member of a volunteer group providing masks to first responders and hospitals, please fill out the order form. We will forward on your request to SMART union members close to you.

SMART sheet metal members stand ready to produce free metal nose pieces for the millions of masks being made by volunteers across the US and Canada. If you are a member of a volunteer group providing masks to first responders and hospitals, please fill out the order form. We will forward on your request to SMART union members close to you.  At the end of last month, North America’s Building Trades Unions (NABTU), an alliance that includes SMART and 13 other unions, announced a partnership with National Nurses United (NNU) to donate N-95 respirator masks and other protective equipment to nurses around the country.

At the end of last month, North America’s Building Trades Unions (NABTU), an alliance that includes SMART and 13 other unions, announced a partnership with National Nurses United (NNU) to donate N-95 respirator masks and other protective equipment to nurses around the country.