After consulting with a number of the largest mechanical contractors in the United States, the ITI (International Training Institute) has enhanced its BIM courses to better meet the training needs expressed by those contractors. The result is a total immersion training experience called BIMmersion.

BIMmersion is separate from the ITI’s Benchmark training. It covers everything you need to know to become a working detailer in a very short amount of time. Courses are limited to 15 students and each is flexible, depending on individual training needs. They can be taken as a full training experience over six weeks, or each class can be taken on its own.

Two of the most popular classes are sure to be Revit and Navisworks, Autodesk’s flagship products for Building Information Modeling:

Revit Course Description Learn how to use Autodesk Revit software. Topics include learning the basics of Revit; creating views of the model; setting up levels and grids; creating walls, floors, ceilings, roofs, stairs, railings, ramps, etc.; adding components to the model; creating and printing sheets; adding annotations and a detailing sheet; creating HVAC systems; creating hydronic systems; creating plumbing systems; creating lighting and power plans.

Navisworks Course Description Learn how to use Autodesk Navisworks software. Topics include learning the main features and functionality of the Navisworks software; open and append 3D files of different formats and save in the Navisworks format; perform visual project model reviews using built-in review and reporting tools; perform interference detection tests between 3D files of different disciplines to check integrity of the design; obtain takeoff data from source models to create material estimates, measure areas, and count components.

The construction industry has changed and you can change with it. These courses are designed to improve your marketability and open the door to new opportunities. For more information or to sign up, visit www.sheetmetal-iti.org (DIRECT LINK HERE) or call Michael Keane at 703-678-7716.

CLICK HERE for complete Course Descriptions.

Author: paul

Local 36 members in St. Louis joined an army of more than 1500 volunteers as part of the Rebuilding Together St. Louis organization’s massive home rehab blitz Saturday. This was part of an effort to provide free home repair for low-income and elderly homeowners.

Joining Local 36 were Plumbers & Pipefitters Local 562, Glaziers Local 513 and IBEW Local 1.

They handled projects from fixing leaky faucets and replacing faulty electrical wiring and service panels to rebuilding outdoor decks and replacing doors, windows, and kitchen & bathroom fixtures and appliances. At the end of the day, Rebuilding Together St. Louis provided more than $677,000 worth of materials and labor at the 55 homes thanks to the army of volunteers.

Right now, President Obama is meeting with key leaders in Asia to finalize the ‘Trans Pacific Partnership’ (TPP) in complete secrecy. Leaked documents show that this secretive plan will censor the Internet and strip away our rights.

We’re going to use a high powered spotlight to project a StopTheSecrecy message on key buildings in Washington D.C. to ensure Obama, the media, and everyone else knows TPP secrecy must be stopped. Visit www.stopthesecrecy.net to take action, today!

//

Next week, the U.S. House of Representatives will consider H.R. 4486, the Military Construction-VA Appropriations Act. Amendments may be offered to this bill that seek to either weaken or repeal the Davis-Bacon Act, as well as to prohibit Project Labor Agreements for federal construction projects.

Next week, the U.S. House of Representatives will consider H.R. 4486, the Military Construction-VA Appropriations Act. Amendments may be offered to this bill that seek to either weaken or repeal the Davis-Bacon Act, as well as to prohibit Project Labor Agreements for federal construction projects.

Click here for a detailed primer about Prevailing Wages and Project Labor Agreements.

Please contact your Representative and urge a vote against any amendment that seeks to weaken or repeal Davis-Bacon, or to prohibit PLAs.

Last year, with the help of thousands of volunteers, letter carriers all across America collected more than 74.4 million pounds of non-perishable food—the second-highest amount since the drive began in 1992, bringing the grand total to just under 1.3 billion pounds.

Last year, with the help of thousands of volunteers, letter carriers all across America collected more than 74.4 million pounds of non-perishable food—the second-highest amount since the drive began in 1992, bringing the grand total to just under 1.3 billion pounds.

“It’s such an easy way for our customers to help people in their own communities,” NALC President Fredric Rolando said. “All they have to do is leave a non-perishable food donation in a bag by their mailboxes. And that’s it! Then, just like we do every Saturday of the year, letter carriers will swing by—only on Saturday, May 10, we’ll be ready to pick up the food donations and make sure they get to a local food bank or other charity within that community.”

Food banks and shelters usually benefit from an upswing in charitable donations during the winter holiday season. By spring, these stocks dwindle. In addition, with the advent of the summer months, many low income families are left scrambling to find food for their children.

In order to meet the high demand for donations, Union members froma cross the labor movement are assisting with the program by volunteering to distribute and collect food in their local communities.

You can help by leaving any non-perishable items by your mailbox on Saturday may 10th where they will be picked up by your local letter carrier.

Those with questions about the drive should contact NALC Community and Membership Outreach Coordinator Pam Donato at 202-662-2489, or send an e-mail to donato@nalc.org.

By Kate Cywinski – Union Sportsmens’ Alliance

A picturesque 550 ft. canyon made up of chasms, plateaus and pinnacles painted in hues of pink, orange, red and purple is something you might expect to see out West—not in southwest Georgia. Yet that’s what visitors find at Providence Canyon State Park—fondly known to locals as Georgia’s Little Grand Canyon. Though formed by erosion resulting from poor farming practices in the 1800s, the canyon is an icon in a region blessed with parks and public access in every direction.

A hiking trail with scenic views is the key draw to Providence Canyon State Park, but until recently, it was dotted with downed trees and limbs and severely overgrown with vegetation, which extended up to 15 feet beyond the fence that runs along the canyon rim. As Park Manager Tracy Yearta was deciding how to address the trail, he got a call from Dave Hall, Recording Secretary for the Columbus Metal Trades Council (CMTC).

“It was a very pleasant surprise to get that call,” said Yearta, who has managed both Providence Canyon State Park and Florence Marina since the parks were restructured a few years back. “It got me rejuvenated because we were trying to form a game plan to tackle a section of park we felt needed the most attention because we didn’t have the manpower to do the whole thing.”

Located in Fort Benning, GA, the CMTC is an umbrella group of six unions including IBEW Local 613, IUOE Local 926, LiUNA Local 515, UA Local 52, IAMAW Local 2699 and SMART Local 85. Its leadership became aware of the Union Sportsmen’s Alliance when union representatives from Atlanta mentioned USA’s Atlanta Conservation Dinner and gun-a-week calendar at monthly meetings. They then learned about USA’s Adopt-A-Park program at a union convention, and that really sparked their interest.

After a few discussions with USA’s conservation project coordinator, Dave Hall, who was nominated to organize a park project, contacted Yearta and laid plans for volunteers to clean up the 7-mile trail beginning at the park entrance.

On February 8, Hall, CMTC President Mike Culpepper and members of each CMTC union along with Pablo Diaz, the human resources manager of CMTC’s main contractor Tiya Management, and his son met up with park staff equipped with chainsaws and determination; they needed both.

After clearing a large section of fence to restore views of the canyon, the 12 volunteers split into two groups and worked from opposite ends of the trail to remove fallen trees, cut dead limbs overhead and refresh trail markers.

“Seven miles is a lengthy area to clear, and when we ran into the other team at the end of the day, you could see the light in everyone’s eyes,” said Hall. “It was one of the most fulfilling events I have ever been a part of! Everyone…had a sense of pride knowing the work we were doing would have a lasting impression on the park staff and our community.”

Following the success of the project, the CMTC has already had follow up discussions with Yearta about more joint projects like improvements to dock and cabin facilities at Florence Marina.

“I just can’t say enough how much I appreciate those guys taking their personal time to come out and help. … It’s really important to the visitors and park staff,” Yearta said. “We basically have one team taking care of two parks, so groups like the Columbus Metal Trades Council are a tremendous asset to the park system.”

The 100th Anniversary of the Ludlow Massacre is upon us. The strike started on September 23, 1913, and the massacre occurred on April 20, 1914, in southern Colorado. The United Mine Workers of America is planning a series of events to commemorate this tragedy. Many academic and labor historian groups have been planning events and speaking engagements on Ludlow.

The 2014 event will be held the weekend of May 18, 2014, to commemorate the 100th Anniversary of the Massacre. April 20, 2014, the date of this tragedy was considered, but that is Easter Sunday. A prayer vigil is being planned for that day, and the remembrance will be held May 18th.

We are jointly writing to you today not only to invite you to attend these functions, but to ask that the SMART Union as a whole commemorate this event. Men, women and children died in the Ludlow struggle for economic justice. It’s our opinion that the greatest tribute we can give them is use the 100th Anniversary to further their cause.

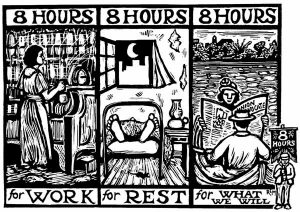

Many of the issues that occurred at the time of the Ludlow Massacre are some of the same issues that we face today. Gone are the issues of the company towns, company guards, scrip pay (coal company money) and tent colonies. However, the attack on collective bargaining rights and the right to organize, economic injustice, immigration, worker health and safety, corporate, political, and media attacks on labor unions,

8-hour work days, and numerous other issues, face all of us today.

The Ludlow workers took on the battle one hundred years ago, and we ask you to honor them by making the centennial events of the strike and massacre our opportunity to redefine the labor movement and to take our rightful place in today’s society.

We feel it is up to all of us who enjoy collective bargaining rights, to use any and every opportunity to speak out, to engage our political friends, as well as our enemies, and when able, to participate in public events and to be a part of any debate about Ludlow and/or any of the issues that still face us today.

Ludlow was a United Mine Workers of America event and in solidarity Colorado SMART Union members plan on offering a tribute to these fallen miners, their wives, and children. We ask that our SMART Union leaders join with us as labor so we can better engage the public in all issues affecting workers.

In closing, thank you for your time and allowing us to pass on this information. Feel free to contact either of us with any questions or comments. We look forward to hearing from you, and to have a large SMART Union contingency at this important event labor history.

Fraternally,

Eric DeBey, Business Manager

SMWIA Local 9

Carl Smith

Director

Colorado Legislative Board

Each year, tens of thousands of American workers are made sick or die from occupational exposures to hazardous chemicals. While many chemicals are suspected of being harmful, OSHA’s exposure standards are out-of-date and inadequately protective for the small number of chemicals that are regulated in the workplace. To help keep workers safe, OSHA has launched two new Web resources.

The first resource is a step-by-step toolkit to identify safer chemicals that can be used in place of more hazardous ones. The Transitioning to Safer Chemicals Toolkit (https://www.osha.gov/dsg/safer_chemicals/index.html) provides employers and workers with information, methods, tools and guidance on using informed substitution in the workplace.

OSHA has also created another new Web resource: the Annotated Permissible Exposure Limits (https://www.osha.gov/dsg/annotated-pels/index.html), which will enable employers to voluntarily adopt newer, more protective workplace exposure limits. Since OSHA’s adoption of the majority of its PELs more than 40 years ago, new scientific data, industrial experience and developments in technology clearly indicate that in many instances these mandatory limits are not sufficiently protective of workers’ health.

“From steel mills to hospitals, from construction sites to nail salons, hazardous chemical exposure is a serious concern for countless employers and workers in many, many industries, in every part of this nation,” said Dr. David Michaels, assistant secretary of labor for occupational safety and health. “With these new resources, OSHA is making sure that all business owners have access to information on safer exposure limits and safer alternatives to help protect their workers and their bottom lines.”

Local Secretary & Treasurer Dale Biggs of SMART Transportation Division Local 240 at Los Angeles reports that the local’s next monthly meeting will be held Wednesday, April 9, at 7 p.m. at Ozzie’s Diner, upstairs.

Biggs is compiling an email list to send out notices of meetings. Please contact Biggs with your email address if you would like to be on the list. He said that the list will only be used for union business.

Biggs can be reached at rrcond55@aol.com.