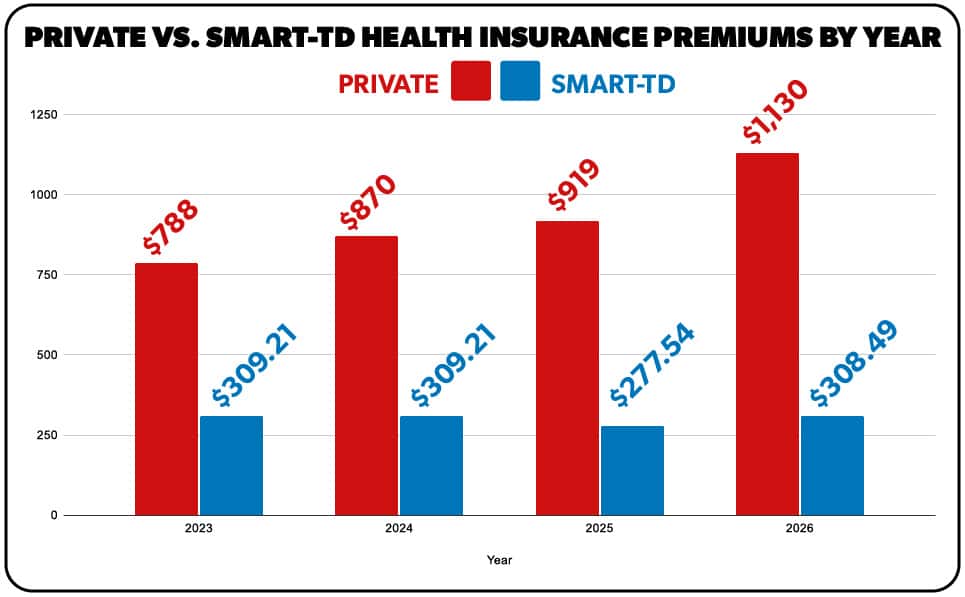

As healthcare costs climb across the country, SMART-TD members under the National Freight Rail Agreement are in a uniquely secure position. While the vast majority of America braces for record-breaking premium hikes, at $308.49 per month, railroaders’ 2026 monthly healthcare contributions remain slightly below the $309.21 that went into effect in 2023.

It is understandable that none of us are celebrating our monthly contributions going up by almost $31 in 2026, but the fact that the carriers’ rates (and therefore our contributions) have remained at or below the same level for four consecutive years is astonishing.

Monthly Out of Pocket Premiums by Year

Even more impressive is the fact that the vast majority of organized rail labor – including most SMART-TD members – have ratified agreements that provide added health & welfare benefits.

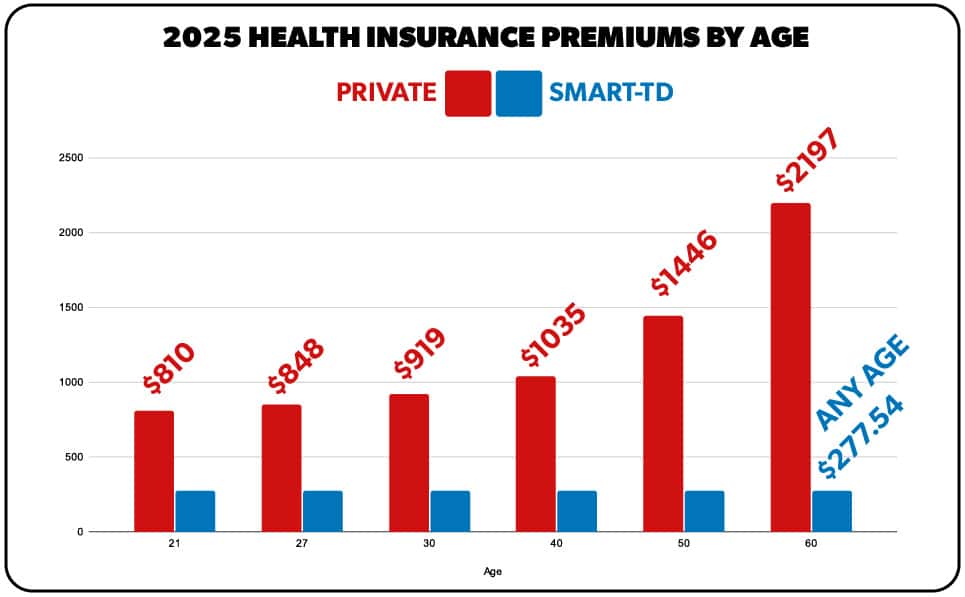

By comparison, many hard-working Americans are being forced to absorb unsustainable rate hikes in 2026. But before we get to that, let’s keep in mind the fact that our healthcare benefits are better than literally anything that can be bought on the open market. The closest thing that can compare is a “Platinum” level plan under the open market, and the out-of-pocket costs for getting care under those plans still fall short of our nationally negotiated benefits.

A National Perspective: What the Rest of America Is Paying

In March 2025, Forbes Magazine published data showing the steep cost of healthcare for Americans under unsubsidized private marketplace plans. The report, based on Healthcare.gov data, revealed the following average monthly premiums:

2025 Premiums by Age (average unsubsidized platinum plan)

By comparison, SMART-TD rail members will pay a flat rate of $308.49 per month in 2026, regardless of their age and regardless of how many dependents are on their plan. Even the youngest workers who benefit from lower private insurance rates will pay nearly 40% more than they would under our healthcare plan.

Moreover, as a result of Congress not allocating funding to subsidize some of those costs, the average American with private health insurance is expected to see a 26% increase in their 2026 premiums!

This results in a 21-year-old railroader under our national agreement having $6,018 in his/her pocket at the end of the year, and our 60-year-old members will have saved $22,662 by the end of 2026. Both of these numbers are in comparison to what they would have paid in premiums compared to the private plan that is the closest to matching our benefit level.

But That’s Private Insurance. What About Other Employer-Sponsored Plans?

According to the Kaiser Family Foundation’s (KFF) 2025 Employer Health Benefits Survey, the average employee contribution for family coverage went from $543.25 per month in 2023, to $570.83 per month in 2025.

That trend is expected to continue at the same rate into 2026 and beyond. Keep in mind that these numbers are also for average healthcare plan benefits – not our exceptional railroad benefits. Railroaders’ costs went from $309.21 per month in 2023, to $308.49 per month in 2026.

Another interesting statistic provided by the KFF is that in 2025, the average non-Union employee paid a 29% contribution toward premiums for family coverage, while the average Union employee paid 21%. SMART-TD national railroad members pay only 15%.

So What Gives? What Makes us Different?

Aside from the obvious – our strong Union and our collective bargaining process – our overall funding and rates have remained stable for several factors. Some of those factors are beyond our control, such as the number of complex cases and high ($1M+) claims, and the overall economic health of our country. Many other factors are in fact under our control, including how we jointly manage our healthcare plans with the Carriers. There are constant decisions being made behind the scenes that do not have any visible impact on our members but can save (or sometimes recover) healthcare plan spending to the tune of hundreds of millions of dollars per year.

In fact, many members are unaware that the premiums for our healthcare plan increased by 1.8% in 2024, by another 3.3% in 2025, and by another 8.7% for 2026. However, we were able to reach agreements with the Carriers to use hundreds of millions in savings to not only offset but completely cancel out and reverse those increases.

But our Healthcare Used to be FREE! We Didn’t Have to Pay Anything! What Happened?

It’s true that we didn’t have to make monthly contributions long ago, however, our healthcare benefits have never been free. Back in 1954-1955, the Unions that later merged to form the UTU each negotiated agreements that provided an option for each General Committee (by vote of its members) to join a group healthcare insurance plan. For opting-in to that healthcare plan, the members gave up a portion of the hourly wage increases in those agreements. Adjusted for inflation, and assuming a 40-hour work week at the Yard Foreman rate, the 2025 equivalent of those wages is $124.89 per month. With those agreements, every single General Committee chose the healthcare coverage over the wage increases. It was a no-brainer.

As for our monthly contributions, copays, deductibles, coinsurance, and out-of-pocket maximums, the Unions never agreed to them. They were imposed in 1991 by Presidential Emergency Board #219. Not only did PEB #219 impose these costs, but it also required that these issues be open to further negotiations in all rounds of future bargaining. It’s something that we’ve had to face ever since, and it will continue to come up, whether we like it or not (we don’t).

The fact is that yes, we are paying more out of pocket for our healthcare than we did in decades past, but that statement alone does not tell the whole story. The Carriers are also paying more – a disproportionately higher amount – and over the decades our agreements have provided wage increases that more than make up for our out of pocket healthcare costs.

Perspective and Pride

From groceries to utilities, inflation has affected every corner of the American household budget, and healthcare has been one of the most volatile costs of all. Thanks to strong national bargaining and responsible management of our benefits, SMART-TD members have been shielded on this front.

So while the 2026 adjustment represents a modest correction from the historic out-of-pocket reduction in 2025, it’s worth emphasizing what sets us apart:

- Our members are paying less in 2026 than in 2023.

- No age-based or family coverage surcharges. Everyone pays the same low rate.

- We remain far below national averages, even for the youngest and healthiest Americans.

The Bottom Line

In all reality, it is reasonable to expect healthcare costs to increase over time. It’s an unfortunate reality that all Americans have faced for decades and will continue to face until (or unless) Congress does something to fix it. It would be foolish to believe that on a long enough timeline, our healthcare costs aren’t going to increase. It would be equally foolish to believe that SMART-TD will fail to secure wage increases and other improvements that will more than offset those added costs.

In the meantime, we remain committed to responsibly managing our healthcare benefits, while also fighting for improvements and finding ways to lower costs. It’s a fight we are accustomed to, because we have been doing it since the mid-1950’s. We have a long, proud track record of proven results, and we have no intention to let up in that fight.

* Year-over-year ACA averages are based on Forbes published 2025 average for a 30-year-old with a platinum plan, modified by year-over-year premium changes as published by the state of Colorado for their healthcare marketplace. “Statewide increases were 5.6% in 2025, 9.7% in 2024, 10.4% in 2023 and 1.1% in 2022.” Actual rates for your state may vary.

Related News

- Members Who Work Federal Holidays Guaranteed Extra Pay Under New Bill

- Safety Starts With Us

- BNSF Seeks Dangerous RCO Waiver

- Mourning the Loss of Brother Benjamin Bicknell

- I’m Not Qualified =’s I’m Not Doing It!

- Train Lengths Would Be Capped Under New Arizona Bill

- Senate Hearing Highlights the Good, the Bad, and The Ugly of RRB

- On-Duty Assault Leaves Amtrak Conductor Facing Financial Hardship

- Transit Equity Day: Remembering Rosa Parks

- Railroads Have Short Memories: East Palestine 3 Years Later