Throughout the past several years, SMART members and working families across the United States have made one thing clear: The system just isn’t working.

The numbers say the same thing. CEO pay in the United States is 281 times the pay of the typical worker (source: Economic Policy Institute). The costs of basic goods continue to increase, including housing, energy and food. More than 60% of Americans live paycheck to paycheck, according to a study by Realtime Inequality published in February 2025.

This rise in inequality, in the United States especially, has been accompanied by a rise in misinformation and conspiracy theories. But there is one conspiracy that’s real — the organized effort by the wealthiest and most powerful entities in the U.S. to get richer at the expense of working people. It’s an attack that has been ongoing for decades, spanning political parties, nations and leaders. And it’s a fight that will require SMART members and working people everywhere to stand together

Union power and the American dream

Things weren’t always this way. When American unions began organizing in the 19th century — including SMART’s predecessor organizations — workers were fighting their way out of poverty, even as robber barons tried their best to suppress the growing movement. By the time World War II came to an end, the landscape had changed. President Franklin Delano Roosevelt’s administration passed laws including the National Industrial Recovery Act and the National Labor Relations Act, which the Library of Congress notes “required businesses to bargain in good faith with any union supported by the majority of their employees” — in other words, outlawing employers’ ability to interfere with workers trying to form a union.

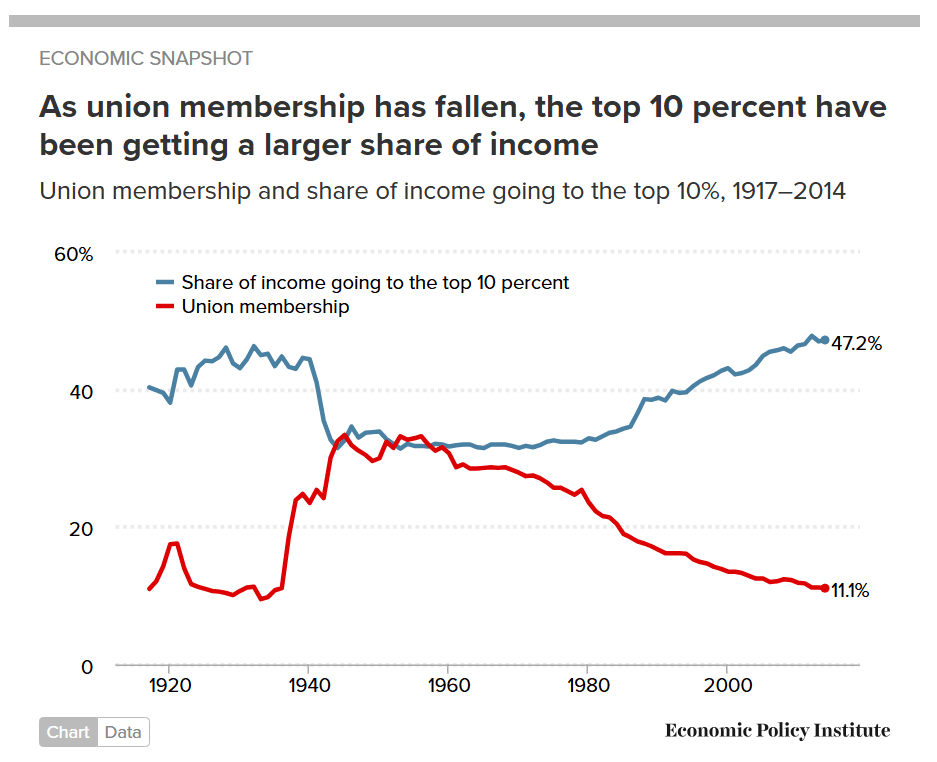

Labor unions organized to new heights in response. In 1936, only around one in 10 households in the United States were union households. By 1955, approximately one-third of U.S. households were union. Millions of workers went on strike in the 1940s, demonstrating the strength of the labor movement. The Economic Policy Institute reported that “when union membership was at its peak (33.4 percent in 1945) the share of income going to the top 10 percent was only 32.6 percent.”

As a result, numerous studies have found, life was looking up for working families in the United States. Income inequality was at an incredible low. Working Americans had a greater share of the wealth and more purchasing power, and they could negotiate for strong contracts that raised wages with the rate of inflation. The American dream was that much more accessible to union members, their families, their children. This was thanks to both the strength of the labor movement and to government policy that focused on the public: Rather than prioritizing individual wealth through the free market, initiatives designed to benefit all Americans helped working people get a leg up in the economy.

Not everything was good. Workers still faced attacks from employers and anti-union legislators, and issues related to jobsite safety plagued workplaces. Additionally, even with the growth of the labor movement, racism, gender-based discrimination and political persecution threatened the livelihoods of working people from coast to coast — including within unions themselves.

Still, progress continued through the following decades. The 1960s Great Society program of President Lyndon B. Johnson “expanded job opportunities and workplace protections,” according to the North Shore AFL-CIO. “Johnson also strengthened labor protections through various anti-poverty initiatives and increased federal funding for job training programs.”

But as the 1960s rolled into the 1970s, things began to change. Corporate elites, anti-worker politicians and others began to organize themselves, setting out to create an America that discarded public benefits and programs in favor of privatization and corporate power.

The results are still felt to this day.

A decades-long attack on American workers

The foundation for the assault on workers and their unions was laid in the late 1940s. The Taft-Hartley Act, passed over President Harry Truman’s veto, restricted the tactics that could be used by the labor movement and enabled states to weaken unions by passing right-to-work laws. This not only negatively impacted union members’ bargaining power; it set the stage for corporations and the wealthy to take power from workers and unions.

Anti-worker entities kicked their plan into high gear in the 1970s. In August 1971, an article in the Monthly Reviewreports, corporate lawyer Lewis Powell wrote a confidential memo to the United States Chamber of Commerce, “calling on corporations and their CEOs to organize a concerted attack on labor … and to use their financial leverage to dominate government.” The number of corporate PACs quadrupled, the article adds, between 1976 and the middle of the 1980s. Powell was later nominated by President Richard Nixon to serve on the United States Supreme Court.

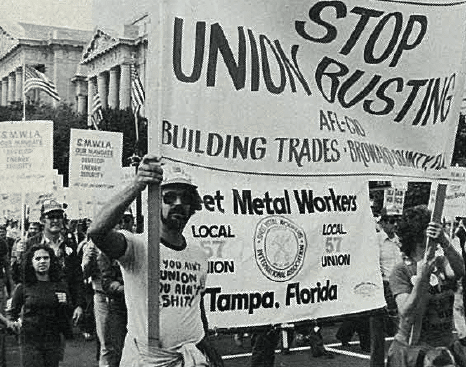

With United States labor law mostly unchanged since the passage of Taft-Hartley, employers started to take advantage, holding captive audience meetings and cracking down on workers’ attempts to organize. The number of anti-union consulting firms skyrocketed throughout the 1970s, according to a consultant’s testimony to Congress. And when unions and worker allies tried to pass labor law reform throughout the decades, corporate-backed lobbyists and anti-worker politicians made sure to defeat it.

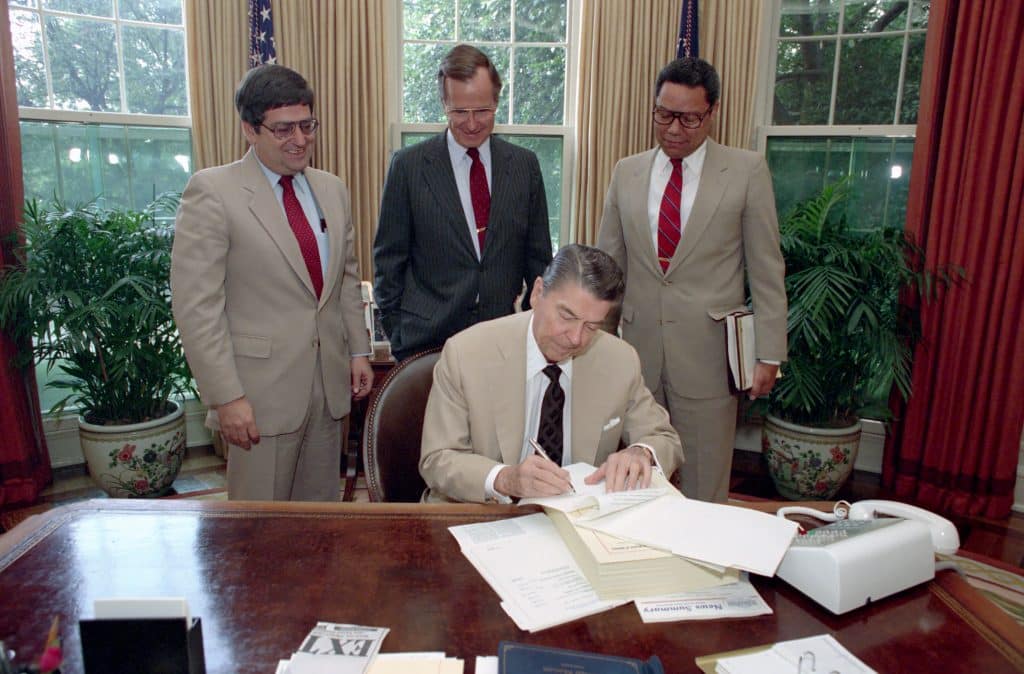

Meanwhile, the domination of government by corporate interests unfolded shortly after Powell’s memo — under the leadership of both political parties.

President Ronald Reagan pursued an aggressive deregulation agenda in the 1980s, and his National Labor Relations Board — filled with management-side appointees — chipped away at workers’ rights while making it easier for employers to harass union members. The Reagan administration famously prioritized “trickle-down” economics, claiming that lowering taxes on the richest Americans would lead to wealth being distributed to the rest of us. The numbers tell a different story: The average annual wages of the top 0.1% in 1979 were $586,222 (in 2021 dollars). The 2021 average annual wages of the top 0.1%? $3,312,693. Compare that with the average annual wages of the bottom 90% of the country, again in 2021 dollars: $28,415 in 1979, and just $36,571 in 2021. That’s not trickling down. SMART members make more thanks to the power of collective bargaining, but still nowhere near the astronomical growth of the rich.

Reagan also famously broke the air traffic controllers’ (PATCO) strike in 1981 — a move that gave corporate America the green light to go on offense and signaled to workers that the U.S. government would no longer stand with union members.

In the 1990s, President Bill Clinton helped pass the North American Free Trade Agreement (NAFTA) — another deregulatory move aimed at boosting trade between Canada, the United States and Mexico. Clinton claimed that NAFTA would lead to an “export boom to Mexico” and create millions of jobs. The reality was very different, as the Economic Policy Institute reports: “U.S. imports from Mexico grew much more rapidly than exports, leading to growing trade deficits … Jobs making cars, electronics, and apparel and other goods moved to Mexico, and job losses piled up in the United States, especially in the Midwest where those products used to be made.”

Canadians suffered similar consequences: “Between 1989 and 1997, 870,700 export jobs were created, but during the same period 1,147,100 jobs were destroyed by imports. Thus, Canada’s trade boom resulted in a net destruction of 276,000 jobs.” And workers in Mexico have not seen substantial wage growth either. In other words, NAFTA empowered companies and corporations to offshore, outsource and prioritize cheap labor over good-paying jobs, across all three countries. Again, the free market was prioritized over the well-being of working people — this time under a Democratic president.

The most recent attack on American workers, once again a giveaway to the wealthy, took place in the summer of 2025, when President Donald Trump signed the One Big Beautiful Bill Act into law. The bill included cuts to Medicaid that will cause working families to suffer and raise the costs of health care plans for SMART members and families, cuts to tax credits that will lead to canceled projects and lost work hours for sheet metal workers, and more. Funding cuts included in the bill have already led to canceled projects, taking work away from members almost immediately. And it’s likely the bill will increase the costs of housing and energy, as well as lead to the closing of nursing homes and rural hospitals nationwide.

In what has become a familiar pattern, these policies — which will increase costs for the American working class — benefit one group of people: the wealthy. The 0.1% will likely gain more than $290,000 each year as a result of tax changes in the “One Big Beautiful Bill.”

For most people in this country, these policies, boosted and enacted for decades, make no sense. They make it harder for working families to live the American dream. But that doesn’t matter to the richest and most powerful among us. For decades, they’ve enacted a conspiracy to disenfranchise the rest of us. And for decades, they’ve succeeded.

Fighting back: strength in solidarity

There’s a reason it so often feels like the odds are stacked against us — they are. But we have something powerful on our side; something that has been at the root of every victory working people have ever won. Our solidarity is our strength. When we come together as millions of individuals to fight collectively as one, we can fix the broken system that prioritizes the few over the many.

We know this from our own history. The gains SMART members and union workers made in the late 1800s and early 1900s would have once seemed unimaginable. Before then, working conditions in industries across North America were largely horrific. Workers’ rights in many places were nonexistent, overtime pay was unheard of, child labor was rampant and deadly workplace accidents were commonplace.

Working people had very little power to fight back. But that changed when workers organized: winning the right to bargain collectively, winning workplace protections, winning pay and benefits that lifted families out of poverty. From a situation that seemed unchangeable, the labor movement created a new way of life.

We face a similar challenge now. American workers are up against more than 50 years of meticulously planned and executed anti-worker strategy. But we have power in numbers. From the ballot box to the bargaining table, whether organizing on the shop floor or on the railroad, now is as good a time as any to fight back — to end the war on working people.