Most Railroad Retirement annuities, like Social Security benefits, will increase in January 2020 due to a rise in the Consumer Price Index (CPI) from the third quarter of 2018 to the corresponding period of the current year.

Cost-of-living increases are calculated in both the Tier I and Tier II benefits included in a Railroad Retirement annuity. Tier I benefits, like Social Security benefits, will increase by 1.6 percent, which is the percentage of the CPI rise. Tier II benefits will go up by 0.5 percent, which is 32.5 percent of the CPI increase. Vested dual benefit payments and supplemental annuities also paid by the Railroad Retirement Board (RRB) are not adjusted for the CPI change.

In January 2020, the average regular Railroad Retirement employee annuity will increase $36 a month to $2,875 and the average of combined benefits for an employee and spouse will increase $50 a month to $4,174. For those aged widow(er)s eligible for an increase, the average annuity will increase $20 a month to $1,428. However, widow(er)s whose annuities are being paid under the Railroad Retirement and Survivors’ Improvement Act of 2001 will not receive annual cost-of-living adjustments until their annuity amount is exceeded by the amount that would have been paid under prior law, counting all interim cost-of-living increases otherwise payable. Almost 52 percent of the widow(er)s on the RRB’s rolls are being paid under the 2001 law.

If a Railroad Retirement or survivor annuitant also receives a Social Security or other government benefit, such as a public service pension, any cost-of-living increase in that benefit will offset the increased Tier I benefit. However, Tier II cost-of-living increases are not reduced by increases in other government benefits. If a widow(er) whose annuity is being paid under the 2001 law is also entitled to an increased government benefit, her or his Railroad Retirement survivor annuity may decrease.

However, the total amount of the combined Railroad Retirement widow(er)’s annuity and other government benefits will not be less than the total payable before the cost-of-living increase and any increase in Medicare premium deductions.

The cost-of-living increase follows a Tier I increase of 2.8 percent in January 2019, which had been the largest in seven years. The Centers for Medicare and Medicaid Services will announce Medicare Part B premiums for 2020 later this year, and this information is available at www.medicare.gov.

In late December the RRB will mail notices to all annuitants providing a breakdown of the annuity rates payable to them in January 2020.

Tag: RRB

Starting October 1, 2019, the U.S. Railroad Retirement Board (RRB) will reduce railroad unemployment and sickness insurance benefits by 5.9%, down from the current 6.2% reduction, as required by law.

The adjusted reduction is based on revised projections of benefit claims and payments under the Railroad Unemployment Insurance Act. It will remain in effect through September 30, 2020, the end of the fiscal year. Reductions in future fiscal years, should they occur, will be calculated based on applicable law.

The current daily benefit rate is $78.00, so the 5.9% reduction in railroad unemployment and sickness benefits will reduce the maximum amount payable in a two-week period with 10 days of unemployment from $780.00 to $733.98.

Certain railroad sickness benefits are also subject to regular tier I railroad retirement taxes, resulting in a further reduction of 7.65%. Applying the 5.9% reduction to these sickness benefits will result in a maximum two-week total of $677.83.

Under the Budget Control Act of 2011, and a subsequent sequestration order to implement mandated cuts, railroad unemployment and sickness insurance benefits are reduced by a set percentage, which is subject to revision at the beginning of each fiscal year.

When sequestration first took effect in March 2013, railroad unemployment and sickness benefits were subject to a 9.2% reduction. This amount was then adjusted to 7.2% in October 2013, 7.3% in October 2014, 6.8% in October 2015, 6.9% in October 2016, 6.6% in October 2017, and 6.2% in October 2018, as required by law.

In fiscal year 2018, the RRB paid about $12.7 billion in retirement and survivor benefits to about 540,000 beneficiaries, and net unemployment-sickness benefits of about $92.6 million to approximately 24,000 claimants.

Thinking of retiring soon?

Pre-Retirement Seminar Booklet

RRB field service representatives conduct each pre-retirement seminar using a slide presentation covering the various benefits provided retired rail workers and their families. Attendees receive a program booklet of this presentation with detailed side notes and fact sheets. In addition to the program booklet, seminar attendees receive a retirement kit full of informational handouts and other helpful materials. Online and downloadable versions of items included with seminar kits are available on the RRB’s Educational Materials webpage.

Schedule and registration

Registration is required to ensure accommodations and materials for all attendees.

- Unless otherwise noted, pre-retirement seminars begin at 8:30 a.m. and are held over the course of 4 hours. (Doors open for attendees 30 minutes before the seminar start time.)

- Security screening is required for seminars hosted inside any Federal buildings. Bring a current, valid photo ID (issued by State/Federal Government); no weapons permitted.

- Parking fee for seminars marked with *.

- Attendees are encouraged to bring original records (or certified copies) of documents required in order to file a railroad retirement application (such as proof of age, marriage or military service), along with an additional copy of each item to leave with field service staff.

- Please let the RRB know if you sign up for a seminar and become unable to attend.

Can’t join the RRB for a seminar, but still interested in learning about the railroad retirement program and application process? Please contact the RRB via Field Office Locator or by calling toll-free (1-877-772-5772) for pre-retirement information or to schedule an appointment for individual retirement counseling at your local RRB field office.

- September 6, 2019: Hilton Garden Inn (Downtown/Convention Center), 305 Korean Veterans Boulevard, Nashville, Tennessee

- September 13, 2019: Bondi Building, 311 East Main Street, Basement Floor, Galesburg, Illinois (Free parking in rear only)

- September 13, 2019: Best Western Plus CottonTree Inn, 1030 N 400 E, North Salt Lake, Utah

- September 20, 2019: Gerald W Heaney Federal Building, 515 W 1st Street, Room 407, Duluth, Minnesota

- October 11, 2019: Richard Bolling Federal Building, 601 E 12th Street, Room G-41 (Dogwood Conference Room), Kansas City, Missouri

- October 18, 2019: Southwest Regional Library, 9725 Dixie Highway, Louisville, Kentucky (10:00 a.m. start time)

- October 18, 2019: Sheet Metal Workers #19 Union Hall, 1301 South Christopher Columbus Boulevard, Philadelphia, Pennsylvania

- October 25, 2019: William S Moorhead Federal Building, 1000 Liberty Avenue, Room 1310, Pittsburgh, Pennsylvania

To RSVP on paper instead, print a registration form to complete, then mail or fax to your local RRB field office.

The U.S. Railroad Retirement Board (RRB) has named Crystal Coleman as its director of programs.

As a result, Ms. Coleman will be responsible for overseeing all operations to process and pay benefits administered by the agency. She will also be a member of the RRB’s executive committee, which is responsible for day-to-day operations of the agency and for making policy recommendations to the three-member board.

At the time of her appointment, Ms. Coleman had served as the RRB’s deputy director of programs since November 2015. In that position, she served as the agency’s second in command on all program-related issues and operations to Dr. Michael A. Tyllas, who retired in December 2018 after more than 37 years of federal service.

Prior to her appointment as deputy director of programs, Ms. Coleman was the deputy regional director of the employee benefits security administration (EBSA) in Dallas. As the number-two official in the regional office, she supervised senior staff and assisted in planning, developing, implementing and evaluating EBSA programs in the region. An agency within the U.S. Department of Labor, the EBSA assures the security of retirement, health and other workplace-related benefits of workers and their families.

An EBSA employee for 24 years, Ms. Coleman previously served as both a supervisory and senior investigator in both Chicago and Los Angeles, as well as the Senior Advisor for Criminal Enforcement in Chicago, before assuming the deputy regional director position in October 2013. Before entering Federal service in 1991, she spent about 18 months as an economic development coordinator for the City of Chicago.

A native and current resident of Chicago, Ms. Coleman attended Illinois State University in Normal, Ill., receiving a bachelor’s degree in communications (1982), and subsequently earned a master’s degree in business administration (1991) from Roosevelt University in Chicago.

Her appointment was effective July 29.

The following questions and answers describe these benefits, their eligibility requirements and how to claim them.

1. What are the eligibility requirements for railroad unemployment and sickness benefits in July 2019?

To qualify for normal railroad unemployment or sickness benefits, an employee must have had railroad earnings of at least $3,900 in the calendar year 2018, counting no more than $1,560 for any month. Those who were first employed in the rail industry in 2018 must also have at least five months of creditable railroad service in 2018.

Under certain conditions, employees who do not qualify on the basis of their 2018 earnings may still be able to receive benefits in the new benefit year. Employees with at least 10 years of service (120 or more months of service) who received normal benefits in the benefit year ending June 30, 2019, may be eligible for extended benefits, and employees with at least 10 years of service (120 or more months of service) might qualify for accelerated benefits if they have rail earnings of at least $4,012.50 in 2019, not counting earnings of more than $1,605 a month.

In order to qualify for extended unemployment benefits, a claimant must not have voluntarily quit work without good cause and not have voluntarily retired. To qualify for extended sickness benefits, a claimant must not have voluntarily retired and must be under age 65.

To be eligible for accelerated benefits, a claimant must have 14 or more consecutive days of unemployment or sickness; not have voluntarily retired or, if claiming unemployment benefits, quit work without good cause; and, when claiming sickness benefits, be under age 65.

2. What is the daily benefit rate payable in the new benefit year beginning July 1, 2019?

Almost all employees will qualify for the maximum daily benefit rate of $78. Benefits are generally payable for the number of days of unemployment or sickness over four in 14-day claim periods, which yields $780 for each two full weeks of unemployment or sickness. Sickness benefits payable for the first 6 months after the month the employee last worked are subject to tier I railroad retirement payroll taxes, unless benefits are being paid for an on-the-job injury. (Claimants should be aware that as a result of a sequestration order under the Budget Control Act of 2011, the RRB will reduce unemployment and sickness benefits by 6.2 percent through September 30, 2019. As a result, the total maximum amount payable in a 2-week period covering 10 days of unemployment or sickness will be $731.64. The maximum amount payable for sickness benefits subject to tier I payroll taxes of 7.65 percent will be $675.67 over two weeks. Future reductions, should they occur, will be calculated based on applicable law.)

3. How long are these benefits payable?

Normal unemployment or sickness benefits are each payable for up to 130 days (26 weeks) in a benefit year. The total amount of each kind of benefit which may be paid in the new benefit year cannot exceed the employee’s railroad earnings in calendar year 2018, counting earnings up to $2,015 per month.

If normal benefits are exhausted, extended benefits are payable for up to 65 days (during seven consecutive 14-day claim periods) to employees with at least 10 years of service (120 or more cumulative service months).

4. What is the waiting-period requirement for unemployment and sickness benefits?

Benefits are normally paid for the number of days of unemployment or sickness over four in 14-day registration periods. Initial sickness claims must also begin with four consecutive days of sickness. However, during the first 14-day claim period in a benefit year, benefits are only payable for each day of unemployment or sickness in excess of seven which, in effect, provides a one-week waiting period. (If an employee has at least five days of unemployment or five days of sickness in a 14-day period, he or she should still file for benefits.) Separate waiting periods are required for unemployment and sickness benefits. However, only one seven-day waiting period is generally required during any period of continuing unemployment or sickness, even if that period continues into a subsequent benefit year.

5. Are there special waiting-period requirements if unemployment is due to a strike?

If a worker is unemployed because of a strike conducted in accordance with the Railway Labor Act, benefits are not payable for days of unemployment during the first 14 days of the strike, but benefits are payable during subsequent 14-day periods.

If a strike is in violation of the Railway Labor Act, unemployment benefits are not payable to employees participating in the strike. However, employees not among those participating in such an illegal strike, but who are unemployed on account of the strike, may receive benefits after the first two weeks of the strike.

While a benefit year waiting period cannot count toward a strike waiting period, the 14-day strike waiting period may count as the benefit year waiting period if a worker subsequently becomes unemployed for reasons other than a strike later in the benefit year.

6. Can employees in train and engine service receive unemployment benefits for days when they are standing by or laying over between scheduled runs?

No, not if they are standing by or laying over between regularly assigned trips or they missed a turn in pool service.

7. Can extra-board employees receive unemployment benefits between jobs?

Yes, but only if the miles and/or hours they actually worked were less than the equivalent of normal full-time work in their class of service during the 14-day claim period. Entitlement to benefits would also depend on the employee’s earnings.

8. How would an employee’s earnings in a claim period affect his or her eligibility for unemployment benefits?

If a claimant’s earnings for days worked, and/or days of vacation, paid leave or other leave in a 14-day registration period are more than a certain indexed amount, no benefits are payable for any days of unemployment in that period. That registration period, however, can be used to satisfy the waiting period.

Earnings include pay from railroad and nonrailroad work, as well as part-time work and self-employment. Earnings also include pay that an employee would have earned except for failure to mark up or report for duty on time, or because he or she missed a turn in pool service or was otherwise not ready or willing to work. For the benefit year that begins July 2019, the amount is $1,560, which corresponds to the base year monthly compensation amount used in determining eligibility for benefits in each year. Also, even if an earnings test applies on the first claim in a benefit year, this will not prevent the first claim from satisfying the waiting period in a benefit year.

On the other hand, earnings of no more than $15 a day from work which is substantially less than full-time and not inconsistent with the holding of normal full-time employment may be considered subsidiary remuneration and may not prevent payment of any days in a claim. However, a claimant must be sure to report all full and part-time work on each claim, regardless of the amount of earnings, so the RRB can determine if the work affects benefits.

9. How does a person apply for and claim unemployment benefits?

Employees can apply for and claim unemployment benefits online or by mail.

Individuals who have established an account at RRB.gov can log in to conveniently file their applications and their biweekly claims online. Employees are encouraged to establish their accounts while still working to expedite the filing process for future unemployment benefits, and for access to other online services.

To apply by mail, claimants must obtain an Application for Unemployment Benefits (Form UI-1) from RRB.gov, any RRB field office, their labor organization or employer. The completed application should be mailed to the local RRB office as soon as possible and, in any case, must be filed within 30 days from the date the claimant became unemployed or the first day for which he or she wishes to claim benefits. Benefits may be lost if the application is filed late. Claimants who know in advance that they will be filing an unemployment application or claim late should include a signed statement explaining why they are unable to meet the required time frame.

The local RRB field office reviews the completed application, whether it was submitted online or by mail, and notifies the claimant’s current railroad employer, and base-year employer, if different. The employer has the right to provide information about the benefit application.

After processing the application, biweekly claim forms are made available on the RRB’s website and are mailed to the claimant, as long as he or she remains unemployed and eligible for benefits. Claim forms should be signed and sent on or after the last day of the claim. This can be done online or by mail. The completed claim must be received by the RRB within 15 days of the end of the claim period, or within 15 days of the date the claim form was made available online or mailed to the claimant, whichever is later. Claimants must not file both an online and a paper claim form for the same period(s). Once an individual submits a claim online, all subsequent claim forms will be made available online only, and will no longer be mailed.

Only one application needs to be filed during a benefit year, even if a claimant becomes unemployed more than once. However, a claimant must, in such a case, request a claim form from the RRB within 30 days of the first day for which he or she wants to resume claiming benefits. These claims may then be filed online or by mail.

10. How does a person apply for and claim sickness benefits?

An Application for Sickness Benefits (SI-1a) can be obtained from RRB.gov, any RRB field office, railroad labor organizations or railroad employers. An application including a doctor’s statement of sickness is required at the beginning of each period of continuing sickness for which benefits are claimed. Claimants should make a special effort to have the doctor’s statement of sickness completed promptly since claims cannot be paid without it.

The RRB suggests that employees keep an application for sickness benefits on hand, and that family members know where the form is kept and how to use it. If an employee becomes unable to work because of sickness or injury, the employee should complete the application and then have his or her doctor complete the Statement of Sickness (SI-1b). If a claimant receives sickness benefits for an injury or illness for which he or she is paid damages, it is important to be aware that the RRB is entitled to reimbursement of either the amount of the benefits paid for the injury or illness, or the net amount of the settlement, after deducting the claimant’s gross medical, hospital and legal expenses, whichever is less.

If the employee is too sick to complete the application, someone else may do so. In such cases, a family member should also complete a Statement of Authority to Act for Employee (Form SI-10), which accompanies the statement of sickness.

After completion, the forms should be mailed to the RRB’s headquarters in Chicago within 10 days from when the employee became sick or injured. However, applications received after 10 days but within 30 days of the first day for which an employee wishes to claim benefits are generally considered timely filed if there is a good reason for the delay. Upon receipt, the RRB will process the application and determine if the employee is eligible for sickness benefits.

After processing the application, the RRB provides biweekly claims to the qualified employee as long as he or she is eligible for benefits and remains unable to work due to illness or injury. Biweekly claims are made available for completion online (by those with an account at RRB.gov) and mailed to the claimant. Completed claim forms must be received at the RRB within 30 days of the last day of the claim period, or within 30 days of the date the claim form was made available online or mailed to the claimant, whichever is later. Benefits may be lost if an application or claim is filed late. Claimants who know in advance that they will be filing a sickness application or claim late should include a signed statement explaining why they are unable to meet the required time frame.

As with claims for unemployment benefits, once a claim for sickness benefits is submitted online, all subsequent claims will be made available online only, and will no longer be mailed.

Claimants are reminded that while claim forms for sickness benefits can be submitted online, applications must be mailed to the RRB. Statements of sickness may be mailed with the sickness application or faxed directly from the doctor’s office to the RRB at 312-751-7185. Faxes must include a cover sheet from the doctor’s office.

11. Is a claimant’s employer notified each time a biweekly claim for unemployment or sickness benefits is filed?

The Railroad Unemployment Insurance Act requires the RRB to notify the claimant’s base-year employer each time a claim for benefits is filed. That employer has the right to submit information relevant to the claim before the RRB makes an initial determination on the claim. In addition, if a claimant’s base-year employer is not his or her current employer, the claimant’s current employer is also notified. The RRB must also notify the claimant’s base-year employer each time benefits are paid to a claimant. The base-year employer may protest the decision to pay benefits. Such a protest does not prevent the timely payment of benefits. However, a claimant may be required to repay benefits if the employer’s protest is ultimately successful. The employer also has the right to appeal an unfavorable decision to the RRB’s Bureau of Hearings and Appeals.

The RRB also conducts checks with other Federal agencies and all 50 states, as well as the District of Columbia and Puerto Rico, to detect fraudulent benefit claims, and it checks with physicians to verify the accuracy of medical statements supporting sickness benefit claims.

12. How long does it take to receive payment?

Under the RRB’s Customer Service Plan, if a claimant files an application for unemployment or sickness benefits, the RRB will release a claim form or a denial letter within 10 days of receiving his or her application. If a claim for subsequent biweekly unemployment or sickness benefits is filed, the RRB will certify a payment or release a denial letter within 10 days of the date the RRB receives the claim form. If the claimant is entitled to benefits, his or her benefits will generally be paid within one week of that decision.

However, some claims for benefits may take longer to handle than others if they are more complex, or if an RRB office has to get information from other people or organizations. If a claimant does not receive a decision notice or payment within the specified time period, he or she may expect an explanation for the delay and an estimate of the time required to make a decision.

Claimants who think an RRB office made the wrong decision about their benefits have the right to ask for a review and to appeal. They will be notified of these rights each time an unfavorable decision is made on their claims.

13. How are payments made?

Railroad unemployment and sickness insurance benefits are paid by direct deposit. With direct deposit, benefit payments are made electronically to an employee’s bank, savings and loan, credit union or other financial institution. New applicants for unemployment and sickness benefits will be asked to provide information needed for direct deposit enrollment.

14. How can claimants get more information on their railroad unemployment or sickness claims?

Claimants with online accounts at RRB.gov can log in to view their individual railroad unemployment insurance account statement. This statement displays the type and amount of the claimant’s last five benefit payments, the claim period for which the payments were made, and the dates that the payments were approved. Individuals can also confirm the RRB’s receipt of applications and claims.

In addition, claimants can call the agency toll-free at 1-877-772-5772 to access the RRB’s automated HelpLine service which provides information about the status of unemployment and sickness claims or payments 24 hours a day, 7 days a week. Individuals with questions about unemployment or sickness benefits, or who need information about their specific claims and benefit payments, can also contact an RRB office by calling the toll-free number.

Persons can find the address of the RRB office serving their area by visiting RRB.gov and clicking on Field Office Locator, or by calling the RRB’s HelpLine service and selecting the appropriate option from the automated menu. Most RRB offices are open to the public on weekdays from 9:00 a.m. to 3:30 p.m., except on Wednesdays when offices are open from 9:00 a.m. to 12:00 p.m. All RRB offices are closed on Federal holidays.

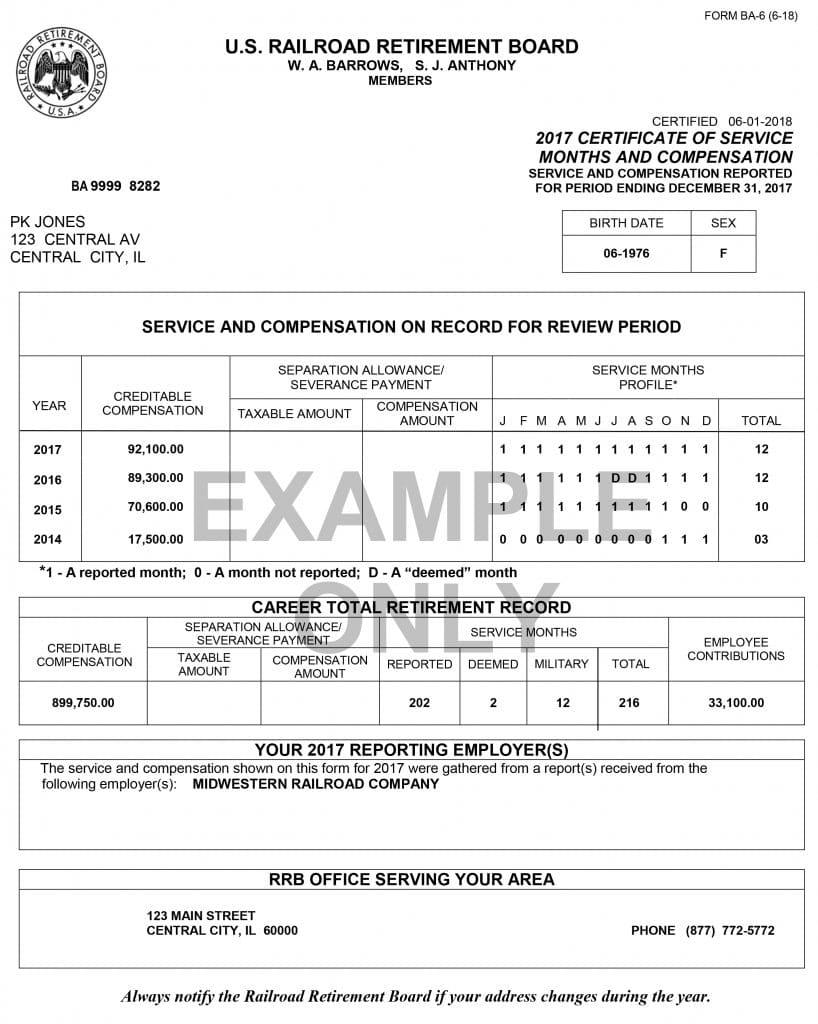

Form BA-6 provides employees with a record of their Railroad Retirement service and compensation, and the information shown is used to determine whether an employee qualifies for benefits and the amount of those benefits. It is important that employees review their Form BA-6 to see whether their own records of service months and creditable compensation agree with the figures shown on the form.

In checking the 2018 compensation total, employees should be aware that only annual earnings up to $128,400 were creditable for Railroad Retirement purposes in that year, and that $128,400 is the maximum amount shown on the form. To assist employees in reviewing their service credits, the form also shows service credited on a month-by-month basis for 2017, 2016, and 2015, when the creditable compensation maximum was $127,200 for 2017 and $118,500 for both 2016 and 2015. The form also identifies the employer(s) reporting the employee’s 2018 service and compensation.

Besides the months of service reported by employers, Form BA-6 shows the number of any additional service months deemed by the RRB. Deemed service months may be credited under certain conditions for an employee who did not work in all 12 months of the year, but had creditable Tier II earnings exceeding monthly prorations of the creditable Tier II earnings maximum for the year. However, the total of reported and deemed service months may never exceed 12 in a calendar year, and no service months, reported or deemed, can be credited after retirement, severance, resignation, discharge or death.

The form also indicates the number of months of verified military service creditable as service under the Railroad Retirement Act, if the service was previously reported to the RRB. Employees are encouraged to submit proofs of age and/or military service in advance of their actual retirement. Filing these proofs with the RRB in advance will streamline the benefit application process and prevent payment delays.

For employees who received separation or severance payments, the section of the form designated “Taxable Amount” shows the amounts reported by employers of any separation allowance or severance payments that were subject to Railroad Retirement Tier II taxes. This information is shown on the form because a lump sum, approximating part or all of the Tier II taxes deducted from such payments made after 1984 which did not provide additional Tier II credits, may be payable by the RRB upon retirement to qualified employees or to survivors if the employee dies before retirement. The amount of an allowance included in an employee’s regular compensation is shown under “Compensation Amount.”

Form BA-6 also shows, in the section designated “Employee Contributions,” the cumulative amount of Tier II Railroad Retirement payroll taxes paid by the employee over and above Tier I Social Security equivalent payroll taxes. While the RRB does not collect or maintain payroll tax information, the agency computes this amount from its compensation records in order to advise retired employees of their payroll tax contributions for federal income tax purposes.

Employees should check their name, address, birth date and sex shown at the top of the form. If the form shows the birth date as 99-9999 and the gender code is “U” (for unknown), it means the RRB is verifying his or her Social Security number with the Social Security Administration. Otherwise, if the personal identifying information is incorrect or incomplete (generally a case where the employee’s surname has more than 10 letters and the form shows only the first 10 letters) or the address is not correct, the employee should contact an RRB field office. The field office can then correct the RRB’s records.

Any other discrepancies in Form BA-6 should be reported promptly in writing to:

Protest Unit-CESC

U.S. Railroad Retirement Board

844 North Rush Street

Chicago, Illinois 60611-1275

The employee must include his or her Social Security number in the letter. Form BA-6 also explains what other documentation and information should be provided. The law limits to four years the period during which corrections to service and compensation amounts can be made.

For most employees, the address of the RRB office serving their area is provided on the form along with the RRB’s nationwide toll-free number (1-877-772-5772). RRB field offices are open to the public on weekdays from 9:00 a.m. to 3:30 p.m., except on Wednesdays when offices are open from 9:00 a.m. to 12:00 p.m. RRB offices are closed on Federal holidays.

Sample BA-6 form:

The following questions and answers show the differences in Railroad Retirement and Social Security benefits payable at the close of the fiscal year ending Sept. 30, 2018. They also show the differences in age requirements and payroll taxes under the two systems.

1. How do the average monthly Railroad Retirement and Social Security benefits paid to retired employees and spouses compare?

The average age annuity being paid by the Railroad Retirement Board (RRB) at the end of fiscal year 2018 to career rail employees was $3,525 a month, and for all retired rail employees, the average was $2,815. The average age retirement benefit being paid under Social Security was approximately $1,415 a month. Spouse benefits averaged $1,035 a month under Railroad Retirement compared to $720 under Social Security.

The Railroad Retirement Act also provides supplemental Railroad Retirement annuities of between $23 and $43 a month, which are payable to employees who retire directly from the rail industry with 25 or more years of service.

2. Are the benefits awarded to recent retirees generally greater than the benefits payable to those who retired years ago?

Yes, because recent awards are based on higher average earnings. Age annuities awarded to career railroad employees retiring in fiscal year 2018 averaged about $4,175 a month, while monthly benefits awarded to workers retiring at full retirement age under Social Security averaged nearly $1,915. If spouse benefits are added, the combined benefits for the employee and spouse would total $5,815 under Railroad Retirement coverage, compared to $2,875 under Social Security. Adding a supplemental annuity to the railroad family’s benefit increases average total benefits for current career rail retirees to about $5,850 a month.

3. How much are the disability benefits currently awarded?

Disabled railroad workers retiring directly from the railroad industry in fiscal year 2018 were awarded $3,050 a month on average, while awards for disabled workers under Social Security averaged $1,340.

While both the Railroad Retirement and Social Security Acts provide benefits to workers who are totally disabled for any regular work, the Railroad Retirement Act also provides disability benefits specifically for employees who are disabled for work in their regular railroad occupation. Employees may be eligible for such an occupational disability annuity at age 60 with 10 years of service, or at any age with 20 years of service.

4. Can railroaders receive benefits at earlier ages than workers under Social Security?

Railroad employees with 30 or more years of creditable service are eligible for regular annuities based on age and service the first full month they are age 60, and rail employees with less than 30 years of creditable service are eligible for regular annuities based on age and service the first full month they are age 62.

No early retirement reduction applies if a rail employee retires at age 60 or older with 30 years of service and his or her retirement is after 2001, or if the employee retired before 2002 at age 62 or older with 30 years of service.

Early retirement reductions are otherwise applied to annuities awarded before full retirement age, the age at which an employee can receive full benefits with no reduction for early retirement. This ranges from age 65 for those born before 1938 to age 67 for those born in 1960 or later, the same as under Social Security.

Under Social Security, a worker cannot begin receiving retirement benefits based on age until age 62, regardless of how long he or she worked, and Social Security retirement benefits are reduced for retirement prior to full retirement age regardless of years of coverage.

5. Can the spouse of a railroader receive a benefit at an earlier age than the spouse of a worker under Social Security?

If a retired railroad employee with 30 or more years of service is age 60, the employee’s spouse is also eligible for an annuity the first full month the spouse is age 60.

Certain early retirement reductions are applied if the employee first became eligible for a 60/30 annuity July 1, 1984, or later, and retired at ages 60 or 61 before 2002. If the employee was awarded a disability annuity, has attained age 60 and has 30 years of service, the spouse can receive an unreduced annuity the first full month she or he is age 60, regardless of whether the employee annuity began before or after 2002, as long as the spouse’s annuity beginning date is after 2001.

To qualify for a spouse’s benefit under Social Security, an applicant must be at least age 62, or any age if caring for a child who is entitled to receive benefits based on the applicant’s spouse’s record.

6. Does Social Security offer any benefits that are not available under Railroad Retirement?

Social Security does pay certain types of benefits that are not available under Railroad Retirement. For example, Social Security provides children’s benefits when an employee is disabled, retired or deceased. Under current law, the Railroad Retirement Act only provides children’s benefits if the employee is deceased.

However, the Railroad Retirement Act includes a special minimum guaranty provision which ensures that railroad families will not receive less in monthly benefits than they would have if railroad earnings were covered by Social Security rather than Railroad Retirement laws. This guaranty is intended to cover situations in which one or more members of a family would otherwise be eligible for a type of Social Security benefit that is not provided under the Railroad Retirement Act. Therefore, if a retired rail employee has children who would otherwise be eligible for a benefit under Social Security, the employee’s annuity can be increased to reflect what Social Security would pay the family.

7. How much are monthly benefits for survivors under Railroad Retirement and Social Security?

Survivor benefits are generally higher if payable by the RRB rather than Social Security. At the end of fiscal year 2018, the average annuity being paid to all aged and disabled widow(er)s was $1,705 a month, compared to $1,305 under Social Security.

Benefits awarded by the RRB in fiscal year 2018 to aged and disabled widow(er)s of railroaders averaged nearly $2,185 a month, compared to approximately $1,265 under Social Security.

The annuities being paid at the end of fiscal year 2018 to widowed mothers/fathers averaged $1,900 a month and children’s annuities averaged $1,110, compared to $985 and $860 a month for widowed mothers/fathers and children, respectively, under Social Security.

Those awarded in fiscal year 2018 averaged $2,200 a month for widowed mothers/fathers and $1,350 a month for children under Railroad Retirement, compared to $960 and $855 for widowed mothers/fathers and children, respectively, under Social Security.

8. How do Railroad Retirement and Social Security lump-sum death benefit provisions differ?

Both the Railroad Retirement and Social Security systems provide a lump-sum death benefit. The Railroad Retirement lump-sum benefit is generally payable only if survivor annuities are not immediately due upon an employee’s death. The Social Security lump-sum benefit may be payable regardless of whether monthly benefits are also due. Both Railroad Retirement and Social Security provide a lump-sum benefit of $255. However, if a railroad employee completed 10 years of creditable railroad service before 1975, the average Railroad Retirement lump-sum benefit payable is $1,020. Also, if an employee had less than 10 years of service, but had at least 5 years of such service after 1995, he or she would have to have had an insured status under Social Security law (counting both Railroad Retirement and Social Security credits) in order for the $255 lump-sum benefit to be payable.

The Social Security lump sum is generally only payable to the widow(er) living with the employee at the time of death. Under Railroad Retirement, if the employee had 10 years of service before 1975, and was not survived by a living-with widow(er), the lump sum may be paid to the funeral home or the payer of the funeral expenses.

9. How do Railroad Retirement and Social Security payroll taxes compare?

Railroad Retirement payroll taxes, like Railroad Retirement benefits, are calculated on a two-tier basis. Rail employees and employers pay Tier I taxes at the same rate as Social Security taxes, 7.65 percent, consisting of 6.20 percent for retirement on earnings up to $132,900 in 2019, and 1.45 percent for Medicare hospital insurance on all earnings. An additional 0.9 percent in Medicare taxes (2.35 percent in total) will be withheld from employees on earnings above $200,000.

In addition, rail employees and employers both pay Tier II taxes which are used to finance Railroad Retirement benefit payments over and above Social Security levels.

In 2019, the Tier II tax rate on earnings up to $98,700 is 4.9 percent for employees and 13.1 percent for employers.

10. How much are regular Railroad Retirement taxes for an employee earning $132,900 in 2019 compared to Social Security taxes?

The maximum amount of regular Railroad Retirement taxes that an employee earning $132,900 can pay in 2019 is $15,003.15, compared to $10,166.85 under Social Security. For railroad employers, the maximum annual regular retirement taxes on an employee earning $132,900 are $23,096.55, compared to $10,166.85 under Social Security. Employees earning over $132,900, and their employers, will pay more in retirement taxes than the above amounts because the Medicare hospital insurance tax is applied to all earnings.

The board recently combined their traditional informational conference program with their pre-retirement seminars to ensure their outreach efforts fulfills current needs. Henceforth, these seminars are open for those nearing retirement, all local union officers, auxiliary members and spouses.

While most of the program focuses on various aspects of Railroad Retirement benefits, each seminar closes with a brief presentation on railroad unemployment and sickness benefits to help prepare union officers for sharing reliable information with their members.

To RSVP for one of the seminars, visit rrb.gov/prs and select your local seminar from the scheduled list, enter your information and hit submit. To RSVP on paper, use the PDF registration form posted at the bottom of the pre-retirement seminar webpage and print it and complete. Then mail or fax your completed form to your local field office. Contact information for each office hosting a seminar can be found by clicking here. Online registration will be available approximately 60 days before the date of each seminar. Registration will close for any seminar that reaches capacity.

Unless otherwise noted, seminars begin at 8:30 a.m. and are held over the course of four hours. Doors open 30 minutes prior to start time. Security screening will be required for seminars hosted inside any federal buildings and photo ID will be required. No weapons are permitted in federal buildings. Attendees are encouraged to bring original records (or certified copies) of documents required in order to file a Railroad Retirement application (such as proof of age, marriage or military service) along with an additional copy of each item to leave with field service staff. Please let the RRB know if you have signed up for a seminar and are unable to attend.

Schedule March – June 2019:

- March 22: George H. Fallon Federal Building. 31 Hopkins Plaza, Room G-33 (ground level), Baltimore, Md.*

- March 22: West Covina Library, 1601 West Covina Parkway, West Covina, Calif.* (9:00 a.m. start time)

- March 29: Birmingham/Jefferson Convention Complex, 2100 Richard Arrington Jr. Boulevard North, East Meeting Rooms D/E, Birmingham, Ala.*

- March 29: Maidu Community Center, 1550 Maidu Drive, Roseville, Calif.

- April 5: Country Inn & Suites, 4500 Circle 75 Parkway, Atlanta, Ga.

- April 5: Hilton Garden Inn (Richmond Airport), 441 International Center Drive, Sandston, Va.

- April 12: Ronald V Dellums Federal Building, 1301 Clay Street – North Tower, 5th Floor (Room H), Oakland, Calif.*

- April 12: Drury Inn & Suites, St Louis Forest Park, 2111 Sulphur Avenue, St. Louis, Mo.

- April 26: Holiday Inn Plainview – Long Island, 215 Sunnyside Boulevard, Plainview, N.Y.

- April 26: Patrick V McNamara Federal Building, 477 Michigan Avenue, Suite 1180, Detroit, Mich.*

- May 3: Hilton Garden Inn, 2465 Grant Avenue, Billings, Mont.

- May 3: Richard Bolling Federal Building, 601 East 12th Street, Room G-41 (Dogwood Conference Room), Kansas City, Mo.

- May 10: Holiday Inn Denver Lakewood, 7390 West Hampden Avenue, Lakewood, Colo.

- May 17: Sheet Metal Workers Local 33, 12515 Corporate Drive, Parma, Ohio

- May 17: Jacob K Javits Federal Building, 26 Federal Plaza, 6th Floor Conference Room, New York, N.Y.*

- June 7: Hilton Garden Inn Portland Airport, 12048 NE Airport Way, Portland, Ore.

- June 7: La Quinta Inn & Suites Indianapolis S, 5120 Victory Dr., Indianapolis, Ind.

- June 14: Eugene T. Mahoney State Park, 28500 West Park Hwy, Ashland, Neb.*

- June 14: Comfort Inn & Suites Presidential, 707 Interstate 30, Little Rock, Ark.

- June 21: Post Office Federal Bldg, 657 Second Ave. N Room 319, Fargo, N.D.

- June 21: Fritz G. Lanham Federal Bldg, 819 Taylor St., Room 4Al4H, Fort Worth, Texas

- June 28: Holiday Inn Huntington-Barboursville, 3551 Rt. 60 East, Barboursville, W.Va.

- June 28: Tinley Park Convention Center, 18451 Convention Center Drive, Tinley Park, Ill.

There is a parking fee required for seminars marked with an *.

1. What were the study’s findings on the life expectancy of retired male railroaders?

The most recent data reflected a continued improvement in longevity. Using data through 2016, the study indicated that, on the average, a male railroader retiring at age 60 can be expected to live another 22.5 years, or 270 months. Studies done three, six and nine years ago indicated life expectancies of 22.4, 21.9 and 21.3 years, respectively, for this category of beneficiary. The study also indicated that a male railroader retiring at age 62 can be expected to live another 20.8 years (approximately 250 months), while the previous three studies indicated life expectancies of 20.7, 20.1 and 19.6 years, respectively. A male railroader retiring at age 65 can be expected to live another 18.3 years (approximately 220 months). The previous studies indicated life expectancies of 18.2, 17.7 and 17.1 years, respectively, for this category of beneficiary.

2. How did these life expectancy figures compare to those of disabled annuitants?

As would be expected, disabled annuitants have a shorter average life expectancy than those who retire based on age. At age 60, a disabled railroader has an average life expectancy of 18 years, or 4.5 years less than a nondisabled male annuitant of the same age. Studies done three, six and nine years ago indicated life expectancies of 17.7, 17.2 and 16.4 years, respectively, for this category of beneficiary. Nonetheless, the difference in life expectancy at age 60 between disabled annuitants and annuitants who retire based on age has remained relatively stable, ranging between 4.5 and 4.9 years.

3. Are women still living longer than men?

In general, women still live longer than men. This is shown both in the Railroad Retirement Board’s life expectancy studies of male and female annuitants and by other studies of the general United States population.

For example, at age 60 a retired female railroader is expected on the average to live 25.6 years, 3.1 years longer than a retired male railroader of the same age; and at age 65, a retired female railroader is expected on the average to live 21.1 years, 2.8 years longer than her male counterpart. Spouses and widows age 65 have average life expectancies of 21 years and 19 years, respectively.

4. Can individuals use life expectancy figures to predict how long they will live?

Life expectancy figures are averages for large groups of people. Any particular individual’s lifetime may be much longer or shorter than the life expectancy of his or her age and group.

According to the study, from a group of 1,000 retired male employees at age 65, 933 will live at least 5 years, 822 at least 10 years, 658 at least 15 years and 448 at least 20 years. Of female age annuitants at age 65, 578 will be alive 20 years later.

5. Where can I access the Railroad Retirement Board’s longevity study?

The entire longevity study is available on the RRB’s website, RRB.gov, under the Financial and Reporting tab (Financial, Actuarial and Statistical).

Designed for railroad employees and spouses planning to retire, the pre-retirement seminars the RRB offers familiarize attendees with the retirement benefits available to them, and also guide them through the application process. Sponsored by the Office of the Labor Member, seminars are held at a number of locations annually.

RRB field service representatives conduct each pre-retirement seminar using a PowerPoint slide presentation covering the various benefits provided to retired rail workers and their families. Attendees receive a program booklet of this presentation with detailed side notes and fact sheets. In addition to the program booklet, seminar attendees receive a retirement kit full of informational handouts and other helpful materials. Online and downloadable versions of items included with seminar kits are available on the RRB’s educational materials webpage.

Registration is required to ensure accommodations and materials for all attendees.

- Unless otherwise noted, pre-retirement seminars begin at 8:30 a.m. and are held over the course of four hours. (Doors open for attendees 30 minutes before the seminar start time.)

- Security screening is required for seminars hosted inside any federal buildings. Bring a current, valid photo ID (issued by state or federal government); no weapons are permitted.

- Parking fee for seminars marked with *.

- Attendees are encouraged to bring original records (or certified copies) of documents required in order to file a Railroad Retirement application (such as proof of age, marriage or military service), along with an additional copy of each item to leave with field service staff.

- Please inform the RRB if you sign up for a seminar and become unable to attend.

Can’t attend a seminar, but still interested in learning about the Railroad Retirement program and application process? Please contact the RRB via the Field Office Locator or by calling toll-free (1-877-772-5772) for pre-retirement information or to schedule an appointment for individual retirement counseling at your local RRB field office.

Here are the scheduled dates:

- March 22, 2019: George H. Fallon Federal Building, 31 Hopkins Plaza, Room G-33 (ground level), Baltimore, Maryland*

- March 22, 2019: West Covina Library, 1601 West Covina Parkway, West Covina, California* (9 a.m. start time)

- March 29, 2019: Birmingham/Jefferson Convention Complex, 2100 Richard Arrington Jr. Boulevard North, East Meeting Rooms D/E, Birmingham, Alabama*

- March 29, 2019: Maidu Community Center, 1550 Maidu Drive, Roseville, California

- April 5, 2019: Country Inn & Suites, 4500 Circle 75 Parkway, Atlanta, Georgia

- April 5, 2019: Hilton Garden Inn (Richmond Airport), 441 International Center Drive, Sandston, Virginia

- April 12, 2019: Ronald V Dellums Federal Building, 1301 Clay Street – North Tower, 5th Floor (Room H), Oakland, California*

- April 12, 2019: Drury Inn & Suites, St Louis Forest Park, 2111 Sulphur Avenue, St Louis, Missouri

Click here to register online.

Click here to print a registration form.