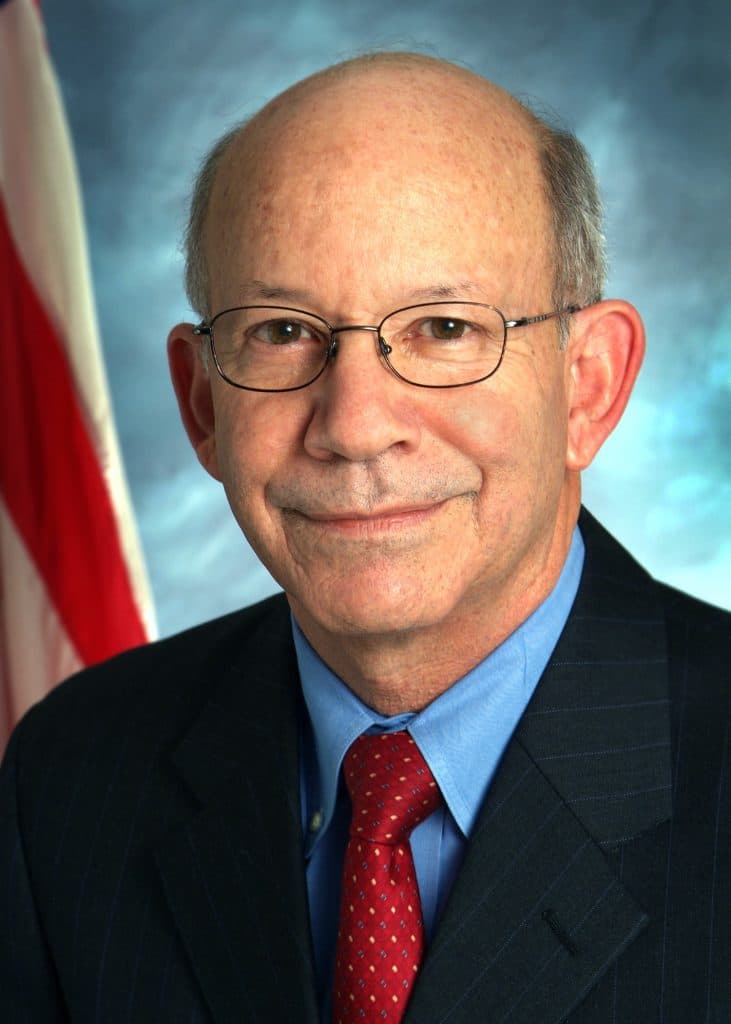

As part of the first SMART Leadership Conference in San Francisco on Aug. 8, Surface Transportation Board Chairman Martin Oberman appeared remotely to address the general session.

The STB, which is tasked with the economic regulation of various modes of surface transportation, primarily freight rail, heard the concerns of SMART Transportation Division President Jeremy Ferguson and three members of the union as well as other labor unions and shippers in April.

As a result of those hearings, the board instituted additional requirements for the large U.S. Class I carriers, including submitting service recovery plans and more recruitment and trainee retention data, bringing some press outlets to say that labor unions, including SMART, “had Oberman’s ear.”

“It isn’t a question of favoring labor or favoring someone else,” Oberman said. “And I have insisted from the outset, and I will continue to do so, that the board wants input and feedback from everybody.”

Class I carriers’ Precision Scheduled Railroading (PSR) operating scheme has lengthened trains and led to a 30% rail workforce reduction among Class I carriers since 2017. Struggles with service and the ability of railroads to retain employees have drawn the attention of federal regulators including the five-member STB.

“It’s been apparent for a long time — certainly since the pandemic began that the Class I railroads just way overdid it in cutting the workforce,” Oberman said. “I don’t know of any business that can operate by taking out 30% of the workforce and have the same level of delivery and productivity and service and products to be delivered.”

Additional employment reductions that happened during the first days of the pandemic made the situation worse and left the rail industry unprepared to deal with the economic rebound.

“They’ve all been struggling to have sufficient people and sufficient crews,” Oberman said of the Class I carriers.

Almost three months in, the more granular reports now being provided by the four U.S.-based Class Is to STB have not shown very good results for carriers attempting to meet the six-month targets their labor recovery plans have set, he said, with Norfolk Southern showing slight improvements in recruitment and T&E worker retention.

“I would say that the news is not great,” he said. “The good news is, it hasn’t got much worse, but the disappointing news is that, with minor exceptions and improvements here and there — they should be acknowledged — there hasn’t been much improvement.

“To say the least, I was hoping to see more improvement during this time period.”

Oberman also remarked that the input the board has received from members of rail labor has been “very enlightening” for the STB

“I really do welcome the input I get,” he said.

Oberman took multiple questions from the audience, including fielding a report out of Seattle and Kent, Wash., regarding service cuts and out of Texas.

In regard to the STB authorization bill proposed recently in the U.S. House, Oberman said that he and the other four board members — two Democrats and two Republicans — will focus on establishing a consensus.

“We don’t have, fortunately, on the board the kind of polarization and tribalism that you see too much in Washington. I am determined to keep that from happening on the board.”

A notice of a meeting of the Surface Transportation Board’s (STB) Rail Energy Transportation Advisory Committee (RETAC) appeared in the

A notice of a meeting of the Surface Transportation Board’s (STB) Rail Energy Transportation Advisory Committee (RETAC) appeared in the