The first shoot is scheduled at 9:30 a.m. Sept. 25 at Colorado Clays, 13600 Lanewood St., Brighton, CO 80603. The second is scheduled at 9:30 a.m. Oct. 23 at Red Wing Sporting Clays, 317 Sooys Landing Road, Port Republic, NJ 08241.

Click here to register for the Sept. 25th event. Click here to register for the Oct. 23rd event. For both events, in-person registration runs 7:30 to 9 a.m. local time, and the entrance fee includes lunch, beverages, 10- or 20-gauge shells and clay targets. Individual registration for those ages 18 and older is $175, while registration for youths is $125.

Individual shooters will be placed in teams of five when competing or entire teams of five can register as a group either in-person or online. The deadline for advance registration is Sept. 20 for the Colorado event and Oct. 18 for the New Jersey event.

Family members and friends of all SMART members can take part in these team shoots, the proceeds of which go toward the Alliance’s efforts to preserve, restore and conserve natural and outdoor resources in our country. In addition to the competition, awards, door prizes and premium drawings will take place at both events. There also are sponsorship opportunities available.

Additional information will be shared as the shoots approach. Questions about registration and sponsorships can be directed to Chris Piltz of the USA at 203-767-0745 or chris@unionsportsmen.org.

Author: amyr

“Across the country, communities are seeking to expand public transit as a way to create economic opportunity, improve safety, advance equity, reduce congestion and pollution, and lower the cost of living for their residents,” said U.S. Transportation Secretary Pete Buttigieg. “These capital projects will improve life in 25 communities and are the start of what we hope will be a once-in-a-generation investment to modernize and expand public transit across the country.”

FTA’s FY 2022 Annual Report on Funding Recommendations includes $1.56 billion for 17 CIG projects with existing grant agreements, and $461.1 million for eight new CIG projects estimated to be ready for grants in FY 2022. An additional $427.2 million is recommended for other CIG and Expedited Project Delivery (EPD) Pilot Program projects that may become ready for funding during FY 2022.

“FTA is proud to work with communities across the country to bring more environmentally friendly public transportation options to residents,” said FTA Deputy Administrator Nuria Fernandez. “These investments support President Biden’s commitment to combat climate change while also improving safety, racial equity and quality of life for thousands of Americans whose lives will be touched by these projects.”

This announcement is consistent with President Joe Biden’s FY 2022 budget, which includes first-time funding recommendations for eight transit projects in five states. These include:

- In Phoenix, Arizona, the Northwest Extension Phase II project would extend Valley Metro’s light rail system 1.5 miles from the existing end-of-line station in northwest Phoenix to the Metrocenter Mall, improving access to the region’s light rail system for residents in various communities in north and west Phoenix, Glendale and Peoria, and support transit-oriented land-use planning in the corridor, including the planned redevelopment of the Metrocenter Mall site.

- In Minnesota, two BRT projects are recommended for funding: 1) The METRO Gold Line BRT project in St. Paul would better connect transit riders traveling along a 10.3-mile corridor on I-94 between downtown St. Paul and the suburban cities of Maplewood, Landfall, Oakdale and Woodbury and, more broadly, connect the eastern part of the Twin Cities metropolitan area to the regional transit network via Union Depot in downtown St. Paul; and 2) The Rochester Rapid Transit BRT project in Rochester would bring BRT service to a 2.6-mile corridor that includes Downtown Rochester, Mayo Clinic campuses, commuter lots and residential neighborhoods.

- In Austin, Texas, two BRT projects are recommended for funding: 1) The Expo Center BRT project would bring BRT service to residents along a 12-mile corridor, connecting East Austin to the University of Texas, downtown Austin and other major employment areas; and 2) The Pleasant Valley BRT project would bring BRT service to a 14-mile corridor connecting residents of the Mueller neighborhood in northeast Austin to the Goodnight Ranch neighborhood in southeast Austin, and other major employment areas such as Dell Children’s Medical Center and Austin Community College (ACC) Eastview.

- In Washington state, two BRT projects are recommended for funding: 1) The RapidRide I Line BRT project in South King County would bring BRT service to suburban communities along a 17-mile corridor between the cities of Renton, Kent and Auburn; and 2) The Pacific Avenue/State Route 7 BRT project in Pierce County would bring BRT service to communities along a 14.3-mile corridor between downtown Tacoma and Spanaway, connecting residents to key destinations such as the Broadway Center for the Performing Arts/Pantages Center, the Greater Tacoma Convention and Trade Center, and the University of Washington Tacoma Campus.

- In Madison, Wisconsin, the Madison East-West BRT project would provide fast, reliable bus service for residents in a key 15.5-mile corridor running along East Washington Avenue, around the State Capitol building, through downtown Madison and the University of Wisconsin-Madison campus, and continuing west on University Avenue to the West Transfer Point or West Towne Mall.

The CIG Program is the federal government’s primary grant program for supporting transit capital projects that are locally planned, implemented and operated. It provides funding for investments such as new and expanded heavy rail, commuter rail, light rail, streetcars, bus rapid transit and ferries, as well as corridor-based BRT investments that emulate the features of rail. The program includes funding for three categories of eligible projects, as defined by the Fixing America’s Surface Transportation (FAST) Act: New Starts, Small Starts and Core Capacity.

FTA’s Annual Report on Funding Recommendations for the Fiscal Year 2022 CIG Program, including links to individual project profiles, is available on FTA’s website.

The following questions and answers describe the survivor benefits payable by the Railroad Retirement Board (RRB) and the eligibility requirements for these benefits.

- What are the general service requirements for Railroad Retirement survivor benefits?

With the exception of one type of lump-sum death benefit, eligibility for survivor benefits depends on whether or not a deceased employee was “insured” under the Railroad Retirement Act. An employee is insured if he or she has at least 120 months (10 years) of railroad service, or 60 months (5 years) performed after 1995, and a “current connection” with the railroad industry as of the month the annuity begins or the month of death, whichever occurs first.

- How is a “current connection” determined under the Railroad Retirement Act?

Generally, an employee who worked for a railroad in at least 12 months in the 30 months immediately preceding the month his or her Railroad Retirement annuity begins will meet the current connection requirement. If an employee dies before retirement, railroad service in at least 12 months in the 30 months before the month of death will meet the current connection requirement for the purpose of paying survivor benefits.

If an employee does not qualify on this basis, but has 12 months of service in an earlier 30-month period, he or she may still meet the current connection requirement. This alternative generally applies if the employee did not have any regular employment outside the railroad industry after the end of the last 30-month period which included 12 months of railroad service and before the month the annuity begins or the month of death, if earlier.

Full- or part-time work for a nonrailroad employer in the interval between the end of the last 30-month period including 12 months of railroad service and the beginning date of an employee’s annuity or the month of death, if earlier, can break a current connection.

Self-employment in an unincorporated business will not break a current connection; however, self-employment can break a current connection if the business is incorporated. All self-employment will be reviewed to determine if it meets the RRA’s standards for maintaining a current connection.

Working for certain U.S. government agencies — Department of Transportation, National Transportation Safety Board, Surface Transportation Board, Transportation Security Administration, National Mediation Board or the Railroad Retirement Board — will not break a current connection. State employment with the Alaska Railroad, so long as that railroad remains an entity of the State of Alaska, will not break a current connection. Also, railroad service in Canada for a Canadian railroad will neither break nor preserve a current connection.

A current connection can also be maintained, for purposes of survivor annuities, if the employee completed 25 years of railroad service, was involuntarily terminated without fault from his or her last job in the rail industry, and did not thereafter decline an offer of employment in the same class or craft in the rail industry, regardless of the distance to the new position.

A current connection determination is made when an employee files for a Railroad Retirement annuity. If an employee dies before applying for an annuity, it is made when an applicant files for a survivor annuity. Once a current connection is established at the time the Railroad Retirement annuity begins, an employee never loses it no matter what kind of work is performed thereafter.

- What if these service requirements are not met?

If a deceased employee did not have an insured status, jurisdiction of any survivor benefits payable is transferred to the Social Security Administration and survivor benefits are paid by that agency instead of the RRB. Regardless of which agency has jurisdiction, the deceased employee’s Railroad Retirement and Social Security credits will be combined for benefit computation purposes.

- What are the age and other eligibility requirements for widow(er)s who haven’t remarried?

Widow(er)s’ benefits are payable at age 60 or over. They are also payable at any age if the widow(er) is caring for an unmarried child of the deceased employee under age 18 or a disabled child of any age who became permanently disabled before age 22. Widow(er)s’ benefits are also payable at ages 50-59 if the widow(er) is totally disabled and unable to work in any regular employment. The disability must have begun within seven years after the employee’s death or within seven years after the termination of an annuity based on caring for a child of the deceased employee. In most cases, a five-month waiting period is required after the onset of disability before disability payments can begin.

Generally, the widow(er) must have been married to the employee for at least nine months prior to death, unless she or he was the natural or adoptive parent of their child, the employee’s death was accidental or while on active duty in the U.S. Armed Forces, the widow(er) was potentially entitled to certain Railroad Retirement or Social Security benefits in the month before the month of marriage, or the marriage was postponed due to state restrictions on the employee’s prior marriage and divorce due to mental incompetence or similar incapacity.

- Can surviving divorced spouses and remarried widow(er)s also qualify for benefits?

Survivor benefits may be payable to a surviving divorced spouse or remarried widow(er). Benefits are limited to the amount Social Security would pay (Tier I only) and therefore are less than the amount of the survivor annuity otherwise payable (Tier I and Tier II) by the RRB. A Tier II benefit is not provided for a surviving divorced spouse or a remarried widow(er).

A surviving divorced spouse may qualify if she or he was married to the employee for at least 10 years immediately before the date the divorce became final, and is age 60 or older (age 50 or older if disabled). A surviving divorced spouse who is unmarried can qualify at any age if caring for the employee’s child and the child is under age 16 or disabled, in which case the 10-year marriage requirement does not apply.

A widow(er) or surviving divorced spouse who remarries after age 60, or a disabled widow(er) or disabled surviving divorced spouse who remarries after age 50 may also receive the portion of a survivor annuity equivalent to a Social Security benefit (Tier I); however, remarriage prior to age 60 (or age 50 if disabled) would not prevent eligibility if that remarriage ended. Such Social Security level benefits may also be paid to a younger widow(er) or surviving divorced spouse caring for the employee’s child who is under age 16 or disabled, if the remarriage is to a person entitled to Railroad Retirement or Social Security benefits, or the remarriage ends.

- When are survivor benefits payable to children and other dependents?

Monthly survivor benefits are payable to an unmarried child under age 18, and to an unmarried child age 18 in full-time attendance at an elementary or secondary school, or in approved homeschooling, until the student attains age 19 or the end of the school term in progress when the student attains age 19. In most cases where a student attains age 19 during the school term, benefits are limited to the two months following the month age 19 is attained. These benefits will be terminated earlier if the student marries, graduates or ceases full-time attendance. An unmarried disabled child over age 18 may qualify if the child became totally disabled before age 22. An unmarried dependent grandchild meeting any of the requirements described above for a child may also qualify if both the grandchild’s parents are deceased or found disabled by the Social Security Administration.

Monthly survivor benefits are also payable to a parent at age 60 who was dependent on the employee for at least half of the parent’s support. If the employee was also survived by a widow(er), surviving divorced spouse or child who could ever qualify for an annuity, the parent’s annuity is limited to the amount that Social Security would pay (Tier I).

- How are Railroad Retirement widow(er)s’ benefits computed?

The Tier I amount of a two-tier survivor benefit is based on the deceased employee’s combined Railroad Retirement and Social Security earnings credits, and is computed using Social Security formulas. In general, the survivor Tier I amount is equal to the amount of survivor benefits that would have been payable under Social Security.

In December 2001, legislation established an “initial minimum amount” which yields, in effect, a widow(er)’s Tier II benefit equal to the Tier II benefit the employee would have received at the time of the award of the widow(er)’s annuity, minus any applicable age reduction.

However, such a Tier II benefit will not receive annual cost-of-living increases until such time as the widow(er)’s annuity, as computed under prior law with all interim cost-of-living increases otherwise payable, exceeds the widow(er)’s annuity as computed under the initial minimum amount formula.

A widow(er) who received a spouse annuity from the RRB is guaranteed that the amount of any widow(er)’s benefit payable will never be less than the annuity she or he was receiving as a spouse in the month before the employee died.

The average annuity awarded to widow(er)s in fiscal year 2020, excluding remarried widow(er)s and surviving divorced spouses, was $2,333 a month. Children received $1,549 a month, on average. Total family benefits for widow(er)s with children averaged $4,395 a month. The average annuity awarded to remarried widow(er)s or surviving divorced spouses in fiscal year 2020 was $1,301 a month.

- Are survivor benefits subject to any reduction for early retirement or disability retirement?

A widow(er), surviving divorced spouse or remarried widow(er) whose annuity begins at full retirement age or later receives the full Tier I amount unless the deceased employee received an annuity that was reduced for early retirement. The eligibility age for a full widow(er)’s annuity is gradually rising to age 67 for those born in 1962 or later, the same as under Social Security. The maximum age reduction is also rising to 20.36%, depending on the widow(er)’s date of birth. For a surviving divorced spouse or remarried widow(er), the maximum age reduction is 28.5%. For a disabled widow(er), disabled surviving divorced spouse or disabled remarried widow(er), the maximum reduction is also 28.5%, even if the annuity begins at age 50.

- Are these benefits subject to offset for the receipt of other benefits?

Under the Railroad Retirement Act, the Tier I portion of a survivor annuity is subject to reduction if any Social Security benefits are also payable, even if the Social Security benefit is based on the survivor’s own earnings. This reduction follows the principles of Social Security law which, in effect, limit payment to the highest of any two or more benefits payable to an individual at one time.

The Tier I portion of a widow(er)’s annuity may also be reduced for the receipt of certain federal, state or local government pension based on the widow(er)’s own earnings. The reduction generally does not apply if the employment on which the public pension is based was covered under the Social Security Act throughout the last 60 months of public employment. However, most military service pensions and payments from the Department of Veterans Affairs will not cause a reduction. Pensions paid by a foreign government or interstate instrumentality will also not cause a reduction.

For those subject to the public pension reduction, the Tier I reduction is equal to 2/3 of the amount of the public pension.

A survivor annuitant should notify the RRB promptly if she or he becomes entitled to any such benefits.

- What if a widow(er) was also a railroad employee and is eligible for a Railroad Retirement employee annuity as well as monthly survivor benefits?

If the widow(er) is entitled to a Railroad Retirement employee annuity and neither the widow(er) nor the deceased employee had any railroad service before 1975, the survivor annuity (Tier I and Tier II) payable to the widow(er) is reduced by the total amount of the widow(er)’s own employee annuity.

If a widow or dependent widower is also a railroad employee annuitant, and either the widow(er) or the deceased employee had at least 120 months of railroad service before 1975, the Tier I reduction may, under certain circumstances, be partially restored in the survivor Tier II amount.

If either the deceased employee or the widow(er) had some railroad service before 1975 but less than 120 months of service, the widow(er)’s own employee annuity and the Tier II portion of the survivor annuity would be payable to the widow(er). The Tier I portion of the survivor annuity would be payable only to the extent that it exceeds the Tier I portion of the widow(er)’s own employee annuity.

- What types of lump-sum death benefits are payable under the Railroad Retirement Act?

A lump-sum death benefit is payable to certain survivors of an employee with 10 or more years of railroad service, or less than 10 years if at least five years were after 1995, and had a current connection with the railroad industry if there is no survivor immediately eligible for a monthly annuity upon the employee’s death.

If the employee did not have 10 years of service before 1975, the lump sum is limited to $255 and is payable only to the widow(er) living in the same household as the employee at the time of the employee’s death.

If the employee had less than 10 years of service but had five years after 1995, he or she must have met Social Security’s insured status requirements for the lump sum to be payable.

If the employee had 10 years of service before 1975, the lump sum is payable to the living-with widow(er). If there is no such widow(er), the lump sum may be paid to the funeral home or the payer of the funeral expenses. These lump sums averaged $1,030 in fiscal year 2020.

If a widow(er) is eligible for monthly benefits at the time of the employee’s death, but the widow(er) had excess earnings deductions which prevented annuity payments or for any other reason did not receive monthly benefits in the 12-month period beginning with the month of the employee’s death totaling at least as much as the lump sum, the difference between the lump-sum benefit and monthly benefits actually paid, if any, is payable in the form of a deferred lump-sum benefit.

The average for all types of lump sums was $933 in fiscal year 2020.

The Railroad Retirement system also provides, under certain conditions, a residual lump-sum death benefit which ensures that a railroad family receives at least as much in benefits as the employee paid in Railroad Retirement taxes before 1975. This benefit is, in effect, a refund of an employee’s pre-1975 Railroad Retirement taxes, after subtraction of any benefits previously paid on the basis of the employee’s service. This benefit is seldom payable.

- How does a person get an estimate of, or apply for, survivor benefits?

As all of the RRB’s 53 field offices are physically closed to the public until further notice because of the COVID-19 pandemic, the best way to obtain a survivor’s annuity estimate is to call the agency’s toll-free number (1-877-772-5772).

Under normal circumstances, applications for survivor benefits are generally filed at one of the RRB’s field offices, with an RRB representative at one of the office’s Customer OutReach Program (CORP) service locations, or by telephone and mail; however, while RRB field offices remain physically closed, applications can be filed solely by telephone and mail by first calling 1-877-772-5772. It is important to note that callers may experience lengthy wait times due to increased call volume caused by COVID-19-related issues.

Notice from John Bragg, the RRB labor member

Brothers and Sisters,

John Bragg

It is hard to believe that 2020 is in the rearview mirror and we are already approaching the mid-point of 2021. The Railroad Retirement Board (RRB) is still operating in a remote capacity with field offices closed to the public. Hopefully, in the not too distant future, I will be writing to advise you of plans for getting back to normal operations. Today, however, I am writing to share a friendly reminder with you about action which every active employee should take on an annual basis – and may be of particular importance this year to some, in light of the unique work circumstances many encountered.

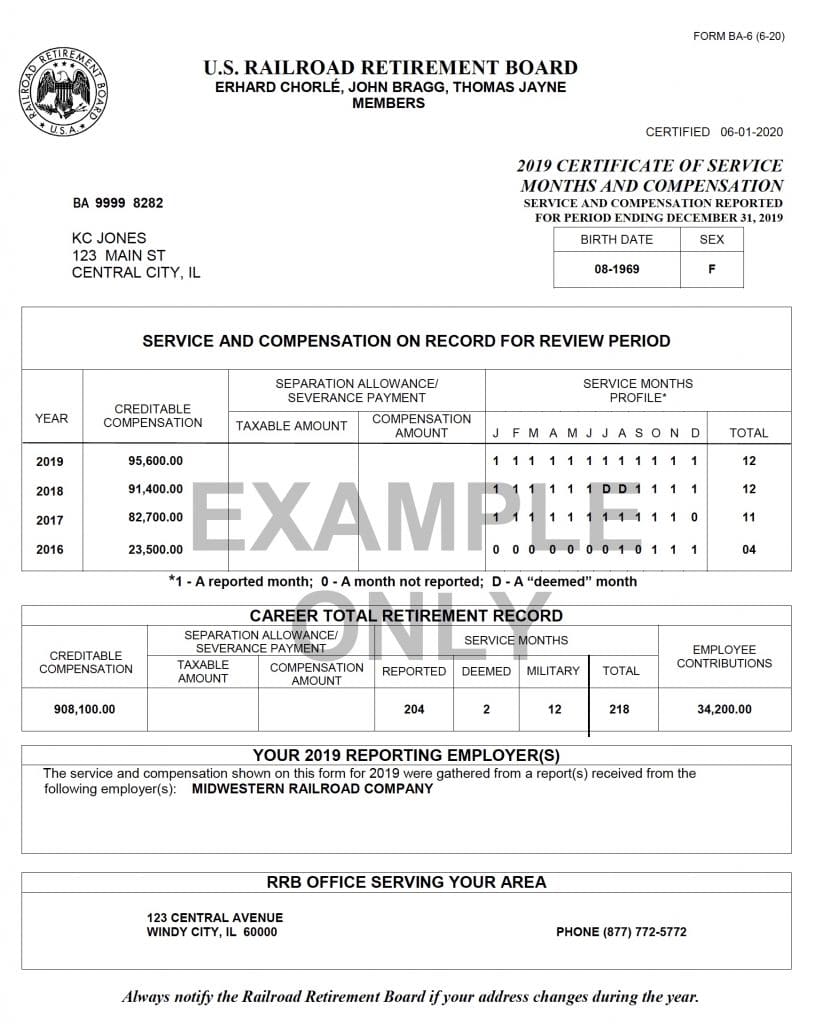

Each year, on or before the last day of February, employers must report service and compensation for each employee who performed compensated service in the preceding calendar year. The RRB, in turn, credits the service and compensation records of individual employees based upon these reports and in June of every year, the RRB releases Form BA-6 to each employee for which compensated service for the preceding year was reported. The Form BA-6 contains the information recently reported for the preceding year, as well as the information reported for three preceding years. For example, the Forms BA-6 which will be released by the RRB in mid-June of 2021 will contain service and compensation reported for the years 2017 through 2020. Regardless of the amount earned, the amount of compensation shown on the Form BA-6 will always be limited by the maximum creditable Tier I compensation amount for the calendar year. For calendar years 2017 through 2020, the maximum amounts creditable are $127,200, $128,400, $132,900 and $137,700, respectively. In addition to showing the creditable compensation for the years 2017 through 2020, the Form BA-6 issued in mid-June of 2021 will show the months for which the employer reported railroad service for the employee during the years 2017-2020.

It is critical that individual employees review their annual Forms BA-6 to make sure that all the information contained on the form is accurate. For example, in addition to validating the creditable compensation, it is important to check to see if the employer properly reported the months for which credit was given by the employer for a month of railroad service. Every month for which you believe you should have credit for railroad service should be coded with a “1”. If the code is “0”, you will not receive credit for any railroad service for that month. If the code is “D” then you will receive credit for railroad service pursuant to the rules governing the deeming of service months.

Employees who received pay for time lost, especially as a result of arbitration proceedings, during the years 2017 through 2020 are reminded of the importance of checking their Forms BA-6. RRB regulations at 20 C.F.R. § 209.15(b) provide that compensation which is pay for time lost must be reported with respect to the year in which the time and compensation were lost. However, it is not uncommon for the individuals responsible for completing reports of service and compensation to be unfamiliar with how to report pay for time lost, or to lack awareness that the compensation they are reporting reflects pay for time lost. As a result, the compensation is mistakenly reported for the year paid AND the service months for which the time and compensation were lost are not credited as railroad service months. Situations where this is most likely to occur are arbitration decisions resulting in the employee being reinstated with all rights and benefits unimpaired and receiving compensation for lost time.

REMEMBER: The law limits the period during which corrections to service and compensation records may be filed to four years from the date the report was due at the RRB, so it is very important for employees to request a correction within that period of time. Any railroad employee who thinks that the Form BA-6 contains an error should be certain to follow the directions on how to file with the RRB a protest of the information contained on the Form BA-6.

RRB Labor Member Press Release:

John Bragg

The Office of the Labor Member is pleased to announce that our 2021 pre-retirement seminar presentation is now available to view online. We designed this program to help educate those nearing retirement about the benefits available to them, and what they can expect during the application process.

This popular program has become a critical resource to RRB customers and employees alike. It helps promote a better understanding of our benefit programs among the railroad community, and in turn, improves the effectiveness of our benefit program operations.

While we typically conduct several seminars across the country annually, we are currently unable to hold in-person events because of COVID-19.

To access the video online, visit RRB.gov/PRS and click on View Pre-Retirement Seminar Presentation. Because we cover several aspects of Railroad Retirement benefits in great detail, the entire presentation is over an hour long. View shorter segments of the program by selecting a seminar topic on the same web page. Available topics include: Retired Employee and Spouse Benefits, Spouse Annuities, Working After Retirement, Survivor Benefits, and Items Affecting All Retirement and Survivor Benefits.

In May, the Hazardous Materials Training Program is planning to host two courses virtually:

In May, the Hazardous Materials Training Program is planning to host two courses virtually:- Disaster Recovery/Response Course (2 hours)

- DOT Hazardous Materials Awareness Course (8 hours over two days)

The Disaster Response Recovery course is training for workers and community members who live and work in areas that are likely to be impacted by a hurricane. The course satisfies the requirements to assist workers and communities in recovery from natural and man-made disasters. The class will be conducted May 17, 2021, at noon ET.

The DOT Hazardous Materials Awareness course, also called the Hazardous Materials Transportation Safety and Security Course, provides safety and security awareness training that is required by the Department of Transportation (DOT) for hazmat transportation workers. This course also provides OSHA first responder – awareness-level training. The course is intended for railroad workers who are involved in the transportation of hazmat and who may be the first on the scene or the first to witness a release of hazardous materials or be aware of a security threat. Various topics will be addressed during the 8-hour (4 hours per day) course held over two days such as the role of the first responder, federal regulatory agencies, DOT’s regulations on hazmat, recognizing and identifying hazmat in transportation and more (see flyer). The class is being offered May 19 – 20, 2021, and May 24 – 25, 2021, from 10 a.m. to 2 p.m. ET. An incentive of $175 is available to participants who complete both days of this course.

Contact the Rail Workers Hazmat Training Program by calling 202-624-6963 (9 a.m. – 5 p.m. ET Monday – Friday).

Click here for a flyer to hang at your workplace.

Click here to register.

The Rail Workers Hazardous Materials Training Program is funded by a federal grant from the National Institute of Environmental Health Sciences (NIEHS) to provide hazmat training to rail workers.

The goal of this training initiative is to provide rail workers with the skills and knowledge necessary to protect themselves, the community, and the environment in a hazardous materials transportation emergency. To achieve this goal, the Rail Workers Hazardous Materials Training Program provides rail workers, through quality hazardous materials training courses, the confidence in their knowledge and problem-solving skills to enable them to make change for safer work conditions.

Much of the training is provided by peer instructors who are full-time rail workers — members and/or local officers of affiliated rail unions.

The Indiana South Shore Line, operated by Northern Indiana Commuter Transportation District (NICTD), is finally going to be revamped, according to Portage.Life.

The very last rider boarded from the 11th Street warming shelter and the train left at 2:18 a.m., Saturday, May 1, and the train rolled to a stop at its destination, the Michigan City station.

According to the article, the 11th Street stop used to be a station, instead of just a warming shelter, and was operational from May 1927 until its closure in 1987. The stop will now be closed down while a new 11th Street Station is constructed along with a parking garage.

But that’s not all that is happening at the South Shore Line, the NICTD is finally getting their double-track program off the ground. According to SMART-TD Indiana State Legislative Director Kenny Edwards, NICTD is going to build 20 miles of double track starting in Michigan City and going westward toward Chicago.

“This is going to reduce the total travel time from 1:40 to 1:00. Along with this double-tracking, there is an eight-mile extension from Dyer to Hammond, Ind. In all, 50 jobs will be added to NICTD alone!” Edwards said.

These changes are a long time coming. Funding was approved under the Obama administration, but the Trump administration put the brakes on the project and made the railroad reapply for funding. Now that the Biden-Harris administration is in control, the project again has a green light.

“This is the future for union job growth and the sustenance of Railroad Retirement,” Edwards added.

Click here to read the full article from Portage.Life.

1st Quarter 2021

Net Earnings: Increased 5% to $1.3 billion from $1.2 billion

Earnings Per Share: n/a – not publicly traded

Revenue: Stayed flat at $5.4 billion

Operating Income: Increased 4% to $1.9 billion from $1.8 billion

Operating Expenses: Decreased 2% to $3.5 billion from $3.6 billion

Operating Ratio: Improved 1.5% to 63.7% from 65.2%

Click here to read BNSF’s full earnings report.

1st Quarter 2021

Net Earnings: Decreased 4% to C$974 million from C$1.011 million

Diluted Earnings Per Share: Decreased 4% to C1.37 from C$1.42

Revenue: Stayed relatively flat, with a slight decrease to C$3.535 million from C$3.545 million

Operating Income: Increased 9% to C$1.327 million from C$1.215 million

Operating Expenses: Stayed relatively flat, with a slight decrease to C$2.208 million from C$2.330 million

Operating Ratio: Improved 3.2 points to 62.5% from 65.7%

Click here to read CN’s full earnings report.

1st Quarter 2021

Net Earnings: Increased 47% to C$602 million from C$409 million

Diluted Earnings Per Share: Increased 51% to $4.50 from $2.98

Revenue: Decreased 4% to C$1.96 billion from C$2.04 billion

Operating Income: Decreased 6% to C$780 million from C$834 million

Operating Expenses: Decreased 2% to C$1.179 million from C$1.209 million

Operating Ratio: Worsened 100 points to 60.2% from 59.2%

Click here to read CP’s full earnings report.

1st Quarter 2021

Net Earnings: Decreased 8% to $706 million from $770 million

Earnings Per Share: Decreased 7% to $0.93 per share from $1.00 per share

Revenue: Decreased 1% to $2.81 billion from $2.86 billion

Operating Income: Decreased 7% to $1.10 billion from $1.18 billion

Operating Expenses: Increased 2% to $1.71 billion from $1.68 billion

Operating Ratio: Worsened by 220 basis points to 60.9% from 58.7%

Click here to read CSX’s full earnings report.

1st Quarter 2021

Net Earnings: Increased 1% to $153 million from $152 million

Diluted Earnings Per Share: Increased 6% to $1.68 from $1.58

Revenue: Decreased 4% to $706 million from $732 million

Operating Income: Decreased 13% to $253 million from $289 million

Operating Expenses: Increased 2% to $453 million from $443 million

Operating Ratio: Worsened 3.7 points to 64.2% from 60.5%

Click here to read KCS’s full earnings report.

1st Quarter 2021

Net Earnings: Increased 77% to $673 million from $381 million

Diluted Earnings Per Share: Increased 81% to a first-quarter record of $2.66 from $1.47

Revenue: Increased 1% to $2.64 billion from $2.63 billion

Operating Income: Increased 79% to a first-quarter record of $1.0 billion from $568 million

Operating Expenses: Decreased 21% to $1.6 billion from $2.1 billion

Operating Ratio: Improved to an all-time quarterly record of 61.5% from 78.4%

Click here to read NS’s full earnings report.

1st Quarter 2021

Net Earnings: Decreased 9% to $1.3 billion from $1.5 billion

Earnings Per Share: Decreased 7% to $2.01 per share from $2.15 per share

Revenue: Decreased 4% to $5.0 billion from $5.2 billion

Operating Income: Decreased 7% to $2.0 billion from $2.1 billion

Operating Expenses: Decreased 3% to $3.0 billion from $3.1 billion

Operating Ratio: Worsened 1.1 points to 60.1% from 59.0%

Click here to read UP’s full earnings report.

Notes:

- Operating ratio is a railroad’s operating expenses expressed as a percentage of operating revenue, and is considered by economists to be the basic measure of carrier profitability. The lower the operating ratio, the more efficient the railroad.

- All comparisons are made to 2020’s first-quarter results for each railroad.

- All figures for CN & CP are in Canadian currency, except for earnings per share for CP

1. How are dual benefits paid to persons entitled to both Railroad Retirement and Social Security benefits?

If a Railroad Retirement annuitant is also awarded a Social Security benefit, the Social Security Administration determines the amount of the Social Security benefit due, but a combined monthly dual benefit payment should, in most cases, be issued by the RRB after the Railroad Retirement annuity has been reduced by the amount of the Social Security benefit.

2. Why is a Railroad Retirement annuity reduced when a Social Security benefit is also payable?

The Tier I portion of a Railroad Retirement annuity is based on both the Railroad Retirement and Social Security earnings credits acquired by an employee and computed under Social Security formulas. It approximates what Social Security would pay if railroad work were covered by Social Security. Tier I benefits are, therefore, reduced by the amount of any actual Social Security benefit paid on the basis of nonrailroad employment, in order to prevent a duplication of benefits based on Social Security-covered earnings.

In addition, following principles of Social Security law which limit payment to the higher of any two or more benefits payable to an individual at one time, the Tier I dual benefit reduction applies to an annuity even if the Social Security benefit is based on the earnings record of someone other than the railroad employee, such as a spouse or former spouse. An annuitant is required to advise the RRB if any benefits are received directly from the Social Security Administration or if those benefits increase (other than for a cost-of-living increase) to avoid a Railroad Retirement benefit overpayment.

The Tier II portion of a Railroad Retirement annuity is based on the railroad employee’s railroad service and earnings alone and is computed under a separate formula. It is not reduced for entitlement to a Social Security benefit.

3. Are there any exceptions to the Railroad Retirement annuity reduction for Social Security benefits?

No. There are no exceptions to the Railroad Retirement annuity reduction for Social Security benefits.

4. Can federal, state or local government pensions also result in dual benefit reductions in an employee’s Railroad Retirement annuity?

Yes. Tier I benefits for employees first eligible for a Railroad Retirement annuity and a federal, state or local government pension after 1985 may be reduced for receipt of a public pension based, in part or in whole, on employment not covered by Social Security or Railroad Retirement after 1956. This may also apply to certain other payments not covered by Railroad Retirement or Social Security, such as payments from a non-profit organization or a foreign government or a foreign employer. Usually, an employee’s Tier I benefit will not be reduced by more than 1/2 of his or her pension from noncovered employment. However, if the employee is under age 65 and receiving a disability annuity, the Tier I benefit may be reduced by an added amount if the pension from noncovered employment is a public disability benefit.

Military service pensions, payments by the Department of Veterans Affairs, or certain benefits payable by a foreign government as a result of a totalization agreement between that government and the United States will not cause a reduction.

5. Can the public service pension reduction apply to spouse or widow(er)s’ benefits?

Yes. The Tier I portion of a spouse’s or widow(er)’s annuity may be reduced for receipt of any federal, state or local government pension separately payable to the spouse or widow(er) based on her or his own earnings. For spouses and widow(er)s subject to a public service pension reduction, the Tier I reduction is equal to 2/3 of the amount of the public service pension.

The reduction generally does not apply if the employment on which the public service pension is based was covered under the Social Security Act throughout the last 60 months of public employment. Most military service pensions and payments from the Department of Veterans Affairs will not cause a reduction. Pensions paid by a foreign government or interstate instrumentality will also not cause a reduction.

6. What dual benefit restrictions apply when both persons in a marriage are railroad employees entitled to Railroad Retirement annuities?

If both parties started railroad employment after 1974, the amount of any spouse or divorced spouse annuity is reduced by the amount of the employee annuity to which the spouse or divorced spouse is also entitled.

If either party had some railroad service before 1975, the spouse or divorced spouse Tier I amount is reduced by the amount of the railroad employee Tier I to which the spouse or divorced spouse is entitled. The spouse or divorced spouse Tier I amount cannot be reduced below zero. The initial reduction is restored in the spouse Tier II amount. Divorced spouses are not entitled to a Tier II component and are not eligible to have the reduction restored.

In survivor cases, if the widow(er) is entitled to a Railroad Retirement employee annuity and neither the widow(er) nor the deceased employee had any railroad service before 1975, the survivor annuity (Tier I and Tier II) payable to the widow(er) is reduced by the total amount of the widow(er)’s own employee annuity.

If a widow or dependent widower is also a railroad employee annuitant, and either the widow(er) or the deceased employee had 120 months of railroad service before 1975, the Tier I reduction may be partially restored in the survivor Tier II amount.

If either the deceased employee or the widow(er) had some railroad service before 1975 but less than 120 months of service, the widow(er)’s own employee annuity and the Tier II portion of the survivor annuity would be payable to the widow(er). The Tier I portion of the survivor annuity would be payable only to the extent that it exceeds the Tier I portion of the widow(er)’s own employee annuity.

7. Can workers’ compensation or public disability benefits affect Railroad Retirement benefits?

If an employee is receiving a Railroad Retirement disability annuity, Tier I benefits for the employee and spouse may, under certain circumstances, be reduced for receipt of workers’ compensation or public disability benefits.

8. How can an annuitant find out if the receipt of any dual benefits affects his or her Railroad Retirement annuity?

If an annuitant becomes entitled to any of the dual benefit payments discussed above, or if there is any question as to whether a dual benefit payment requires a reduction in an annuity, he or she should contact an RRB field office online or by phone. As all of the RRB’s 53 field offices are physically closed to the public until further notice because of the COVID-19 pandemic, customers are encouraged to contact their local office by accessing Field Office Locator at RRB.gov and clicking on Send a Secure Message at the bottom of their local office’s page. Customers who prefer talking to an RRB employee can call the agency’s toll-free number (1-877-772-5772); however, they may experience lengthy wait times due to increased call volume caused by COVID-19-related issues.