The federal Medicare program provides hospital and medical insurance protection for Railroad Retirement annuitants and their families, just as it does for Social Security beneficiaries. Medicare has the following parts:

- Medicare Part A (hospital insurance) helps pay for inpatient care in hospitals and skilled nursing facilities (following a hospital stay), some home health care services and hospice care. Part A is financed through payroll taxes paid by employees and employers.

- Medicare Part B (medical insurance) helps pay for medically-necessary services like doctors’ services and outpatient care. Part B also helps cover some preventive services. Part B is financed by premiums paid by participants and by federal general revenue funds.

- Medicare Part C (Medicare Advantage Plans) is another way to get Medicare benefits. It combines Part A, Part B, and sometimes, Part D (prescription drug) coverage. Medicare Advantage Plans are managed by private insurance companies approved by Medicare.

- Medicare Part D (Medicare prescription drug coverage) offers voluntary insurance coverage for prescription drugs through Medicare prescription drug plans and other health plan options.

The following questions and answers provide basic information on Medicare eligibility and coverage, as well as other information on the Medicare program.

1. Who is eligible for Medicare?

All Railroad Retirement beneficiaries age 65 or over and other persons who are directly or potentially eligible for Railroad Retirement benefits are covered by the program. Although the age requirements for some unreduced Railroad Retirement benefits have risen just like the Social Security requirements, beneficiaries are still eligible for Medicare at age 65.

Coverage before age 65 is available for disabled employee annuitants who have been entitled to monthly benefits based on total disability for at least 24 months and have a disability insured status under Social Security law. There is no 24-month waiting period for those who have ALS (Amyotrophic Lateral Sclerosis), also known as Lou Gehrig’s disease.

If entitled to monthly benefits based on an occupational disability, and the individual has been granted a disability freeze, he or she is eligible for Medicare starting with the 30th month after the freeze date or, if later, the 25th month after he or she became entitled to monthly benefits. If receiving benefits due to occupational disability and the person has not been granted a disability freeze, he or she is generally eligible for Medicare at age 65. (The standards for a disability freeze determination follow Social Security law and are comparable to the medical criteria a person must meet to be granted a total disability.)

Under certain conditions, spouses, divorced spouses, surviving divorced spouses, widow(er)s, or a dependent parent may be eligible for Medicare hospital insurance based on an employee’s work record when the spouse, etc., turns 65. Also, disabled widow(er)s under 65, disabled surviving divorced spouses under 65, and disabled children may be eligible for Medicare, usually after a 24-month waiting period.

Medicare coverage at any age on the basis of permanent kidney failure requiring hemodialysis or receipt of a kidney transplant is also available to employee annuitants, employees who have not retired but meet certain minimum service requirements, spouses and dependent children. The Social Security Administration has jurisdiction over Medicare in these cases. Therefore, a Social Security office should be contacted for information on coverage for kidney disease.

2. How do persons enroll in Medicare?

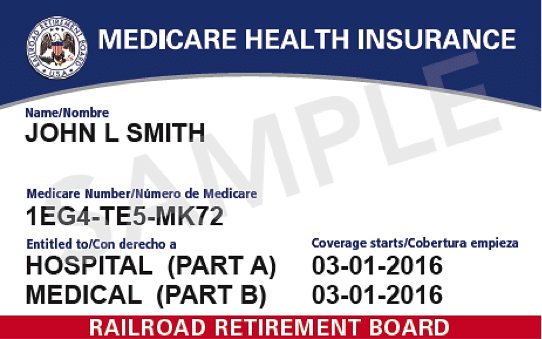

If a retired employee or a family member is receiving a Railroad Retirement annuity, enrollment for both Medicare Part A and Part B is generally automatic and coverage begins when the person reaches age 65. For beneficiaries who are totally disabled, both Medicare Part A and Part B start automatically with the 30th month after the beneficiary became disabled or, if later, the 25th month after the beneficiary became entitled to monthly benefits. Even though enrollment is automatic, an individual may decline Part B; this does not prevent him or her from applying for Part B at a later date. However, premiums may be higher if enrollment is delayed. (See question five for more information on delayed enrollment.)

If an individual is eligible for, but not receiving an annuity, he or she should contact the nearest Railroad Retirement Board (RRB) office before attaining age 65 and apply for both Part A and Part B. (This does not mean that the individual must retire, if working.) The best time to apply is during the three months before the month in which the individual reaches age 65. He or she will then have both Part A and Part B protection beginning with the month age 65 is reached. If the individual does not enroll for Part B in the three months before attaining age 65, he or she can enroll in the month age 65 is reached, or during the three months that follow, but there will be a delay of 1 to 3 months before Part B is effective. Individuals who do not enroll during this “initial enrollment period” may sign up in any “general enrollment period” (January 1 – March 31 each year). Coverage for such individuals begins July 1 of the year of enrollment.

3. Are there costs associated with Medicare Part A (hospital insurance)?

Yes. While individuals don’t have to pay a premium to receive Medicare Part A, recipients of Part A benefits are billed by the hospital for a deductible amount ($1,364 in 2019), as well as any coinsurance amount due and any noncovered services. The remainder of the bill from the hospital, as well as bills for services in skilled nursing facilities or home health visits, is sent to Medicare to pay its share.

4. What are the costs associated with Medicare Part B (medical insurance)?

Anyone eligible for Medicare hospital insurance (Part A) can enroll in Medicare medical insurance (Part B) by paying a monthly premium. The standard premium is $135.50 in 2019. However, some Medicare beneficiaries will not pay this amount because of a provision in the law that states Part B premiums for current enrollees cannot increase by more than the amount of the cost-of-living increase for Social Security (Railroad Retirement Tier I) benefits. Since that adjustment was 2.8 percent for 2019, about 2 million Medicare beneficiaries saw an increase in their Part B premiums, but still pay less than $135.50. The standard premium amount applies to new enrollees in the program, and certain beneficiaries who pay higher premiums based on their modified adjusted gross income.

Monthly premiums for some beneficiaries are greater, depending on a beneficiary’s or married couple’s modified adjusted gross income. The income-related Part B premiums for 2019 are $189.60, $270.90, $352.20, $433.40, or $460.50, depending on how much a beneficiary’s modified adjusted gross income exceeds $85,000 ($170,000 for a married couple), with the highest premium rates only paid by beneficiaries whose modified adjusted gross incomes are over $500,000 ($750,000 for a married couple).

There is also an annual deductible ($185 in 2019) for Part B services.

Palmetto GBA, a subsidiary of Blue Cross and Blue Shield, generally processes claims for Part B benefits filed on behalf of Railroad Retirement beneficiaries in the Original Medicare Plan (the traditional fee-for-service Medicare plan). An individual in the Original Medicare Plan should have his or her hospital, doctor, or other health care provider submit Part B claims directly to:

Palmetto GBA

Railroad Medicare Part B Office

P.O. Box 10066

Augusta, GA 30999-0001

1-800-833-4455

www.palmettogba.com/medicare

Persons with questions about Part B claims under the Original Medicare Plan can contact Palmetto GBA as noted above.

5. Can Medicare Part B premiums increase for delayed enrollment?

Yes. Premiums for Part B are increased 10% for each 12-month period the individual could have been, but was not, enrolled. However, individuals age 65 or older who wait to enroll in Part B because they have group health plan coverage based on their own or their spouse’s current employment may not have to pay higher premiums because they may be eligible for “special enrollment periods.” The same special enrollment period rules apply to disabled individuals, except that the group health insurance may be based on the current employment of the individual, his or her spouse or a family member.

Individuals deciding when to enroll in Medicare Part B must consider how this will affect eligibility for health insurance policies which supplement Medicare coverage. These include “Medigap” insurance and prescription drug coverage and are explained in the answers to questions six through eight.

6. What is Medigap insurance?

Many private insurance companies sell insurance, known as “Medigap,” that helps pay for services not covered by the Original Medicare Plan. Policies may cover deductibles, coinsurance, copayments, health care outside the United States and more. Generally, individuals need Medicare Part A and Part B to enroll, and a monthly premium is charged. When someone first enrolls in Medicare Part B at age 65 or older, he or she has a one-time 6-month “Medigap open enrollment period.” During this period, an insurance company cannot deny coverage, place conditions on a policy, or charge more for a policy because of past or present health problems.

7. Do Medicare beneficiaries have choices available for receiving health care services?

Yes. Under the Original Medicare Plan, the fee-for-service Medicare plan that is available nationwide, a beneficiary can see any doctor or provider who accepts Medicare from qualified Railroad Retirement beneficiaries and is accepting new Medicare patients. Those enrolled in the Original Medicare Plan who want prescription drug coverage must join a Medicare prescription drug plan as described in question eight.

However, a beneficiary may opt to choose a Medicare Advantage Plan (Part C) instead. These plans are managed by Medicare-approved private insurance companies. Medicare Advantage Plans combine Medicare Part A and Part B coverage, and are available in most areas of the country. An individual must have Medicare Part A and Part B to join a Medicare Advantage Plan, and must live in the plan’s service area. Medicare Advantage Plan choices include regional preferred provider organizations (PPOs), health maintenance organizations (HMOs), private fee-for-service plans and others. A PPO is a plan under which a beneficiary uses doctors, hospitals and providers belonging to a network; beneficiaries can use doctors, hospitals and providers outside the network for an additional cost. Under a Medicare Advantage Plan, a beneficiary may pay lower copayments and receive extra benefits. Most plans also include Medicare prescription drug coverage (Part D).

8. How does Medicare Part D (Medicare prescription drug coverage) work?

Medicare contracts with private companies to offer beneficiaries voluntary prescription drug coverage through a variety of options, with different covered prescriptions and different costs. Beneficiaries pay a monthly premium (averaging about $33 in 2019), a yearly deductible (up to $415 in 2019) and part of the cost of prescriptions. Those with limited income and resources may qualify for help in paying some prescription drug costs.

The Affordable Care Act requires some Part D beneficiaries to also pay a monthly adjustment amount, depending on a beneficiary’s or married couple’s modified adjusted gross income. The Part D income-related monthly adjustment amounts in 2019 are $12.40, $31.90, $51.40, $70.90, or $77.40, depending on the extent to which an individual beneficiary’s modified adjusted gross income exceeds $85,000 ($170,000 for a married couple), with the highest amounts only paid by beneficiaries whose incomes are over $500,000 ($750,000 for a married couple).

To enroll, individuals must have Medicare Part A and live in the prescription drug benefit plan’s service area. Beneficiaries can join during the period that starts three months before the month their Medicare coverage starts and ends three months after that month. There may be a higher premium if an individual does not join a Medicare drug plan when first eligible. A beneficiary can generally join or change plans once each year during an enrollment period from October 15 through December 7. Drug coverage would then begin January 1 of the following year. In most cases, there is no automatic enrollment to get a Medicare prescription drug plan. Individuals enrolled in Medicare Advantage Plans will generally get their prescription drug coverage through their plan.

9. Where can I get more information about the Medicare program?

General information on Medicare coverage for Railroad Retirement beneficiaries is available on the RRB’s website, RRB.gov, under the Benefits tab (Medicare) or by contacting an RRB field office toll-free at 1-877-772-5772.

More detailed information on Medicare’s benefits, costs, and health care options are available from the Center for Medicare & Medicaid Services (CMS) publication Medicare & You, which is mailed to Medicare beneficiary households each fall and to new Medicare beneficiaries when they become eligible for coverage. Medicare & You and other publications are also available by visiting Medicare’s website, Medicare.gov, or by calling the Medicare toll-free number, 1-800-MEDICARE (1-800-633-4227).